This is the continuation of the research in this main post and addendum post. We remove earnings yield from regression for stock index returns. The rates-only.py code is from GitHub/asarantsev repository 3spreads-CAPE-simulator

Consider annual S&P returns (price/total, nominal/real)

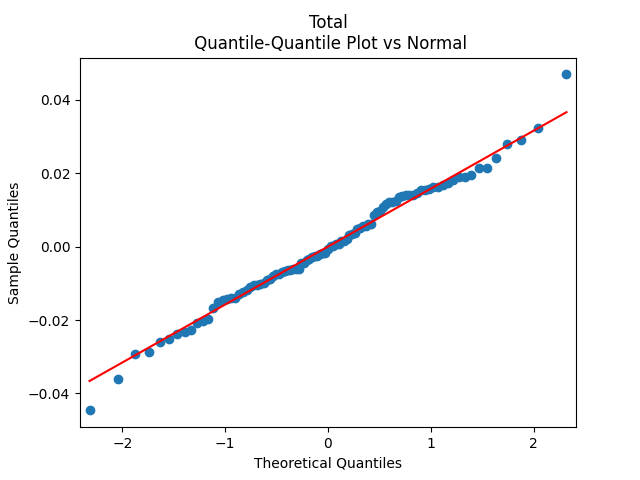

Standard analysis of residuals explained in this main post shows they are well modeled as independent identically distributed Gaussian. All

are not significant: Student T-test has p-values greater than 5%. The most significant (having the smallest p-values) is

corresponding to the BAA-AAA spread. Exceptions: for Total Nominal Returns,

has

The coefficient

is very statistically significant with

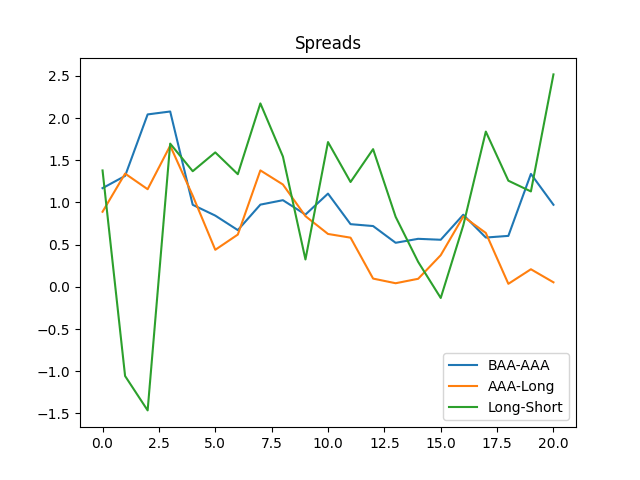

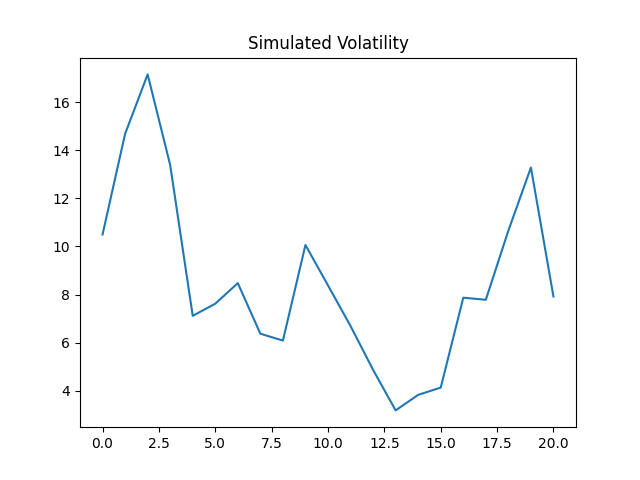

See below the graphs for simulated volatility and spreads.

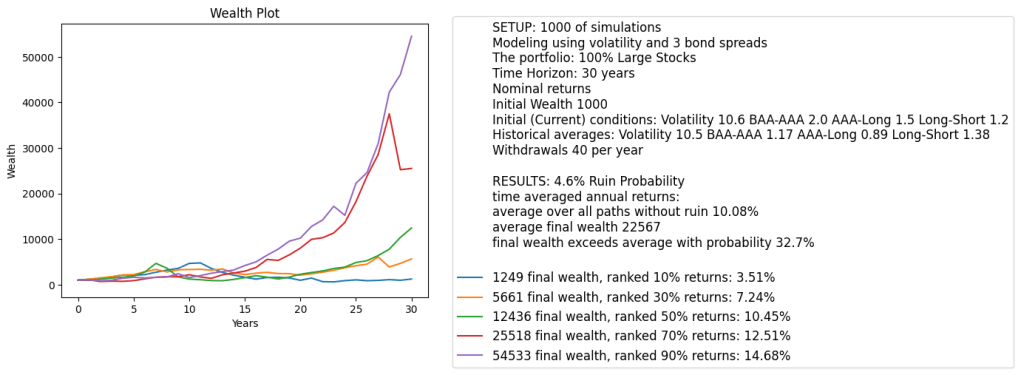

We added to this GitHub repository the entire simulator for the rates-only model (with annual volatility, of course). It is done in Python file rates-only-sim.py in the same repository. See below the graph.

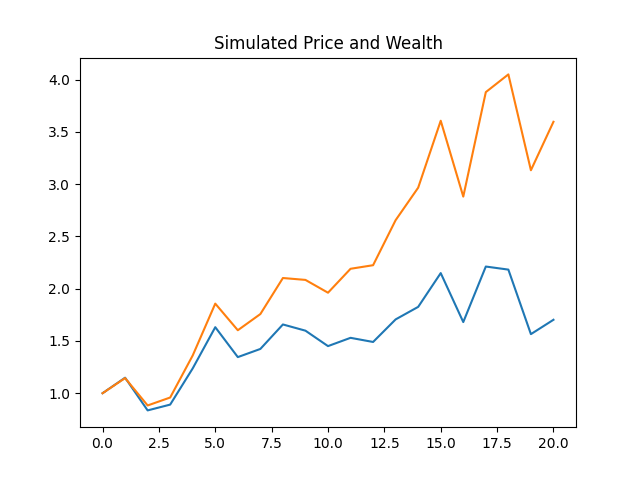

Below we show one simulated path of prices and wealth. This simulation is for the case of real (inflation-adjusted) version and 20-year horizon.

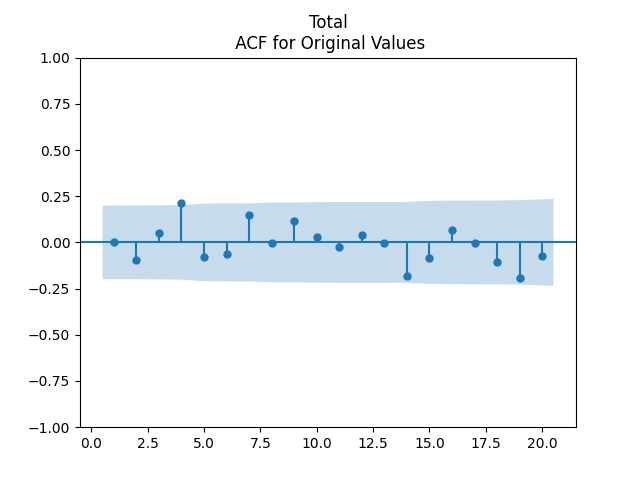

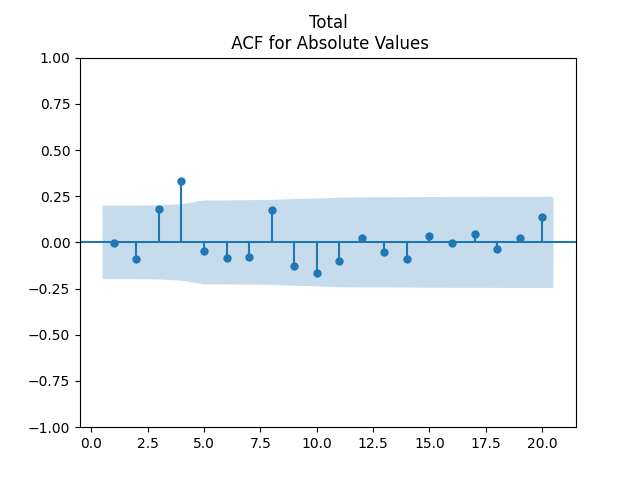

Finally, pick for the case of total nominal returns. Below we see the autocorrelation plot for

, for

, and the quantile-quantile plot for

versus the Gaussian distribution.

As before, we have this strange value at lag 4 for autocorrelation. This presents no problem, since other values are low.

Leave a comment