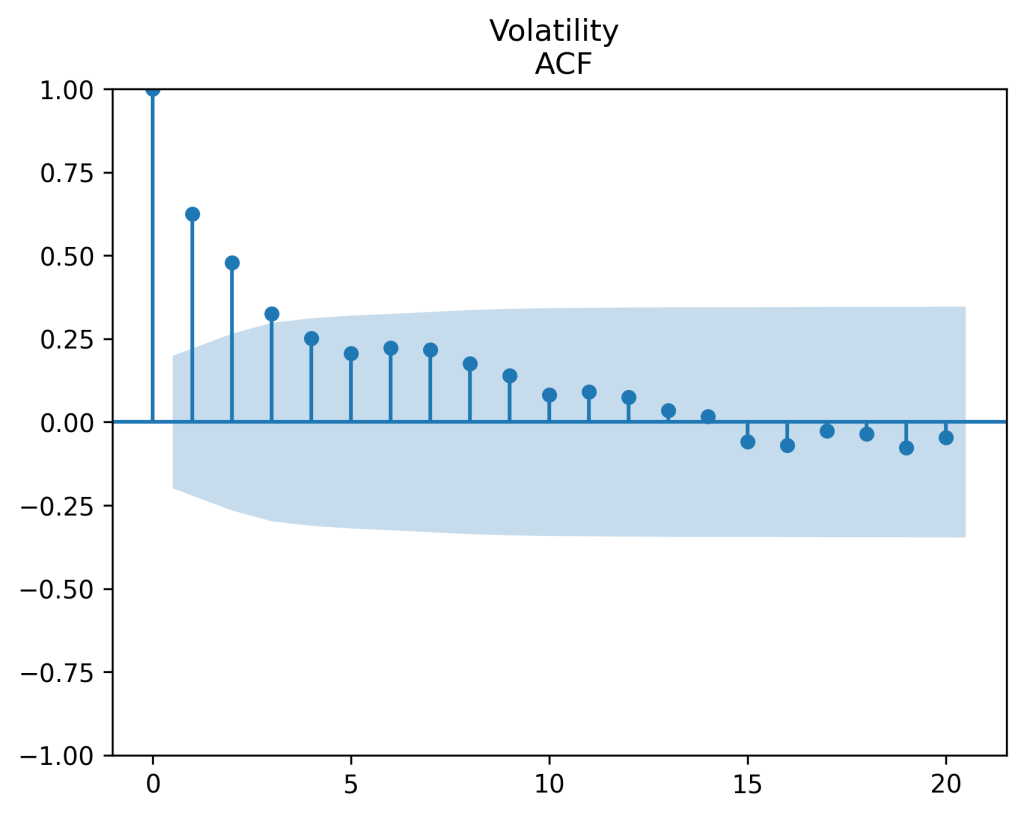

My undergraduate student Angel Piotrowski updated annual realized volatility for 2024. Previously she computed it for 1928-2023, each year. She took log change in daily closing prices of the Standard & Poor 500, or its predecessor, Standard & Poor 90, and computed empirical standard deviation. Given this annual volatility data she analyzed this. First, she computed the autocorrelation function for

This strongly suggests using the autoregression model, which is called the Heston model in quantitative finance:

Results after fitting this simple linear regression using ordinary least squares method are:

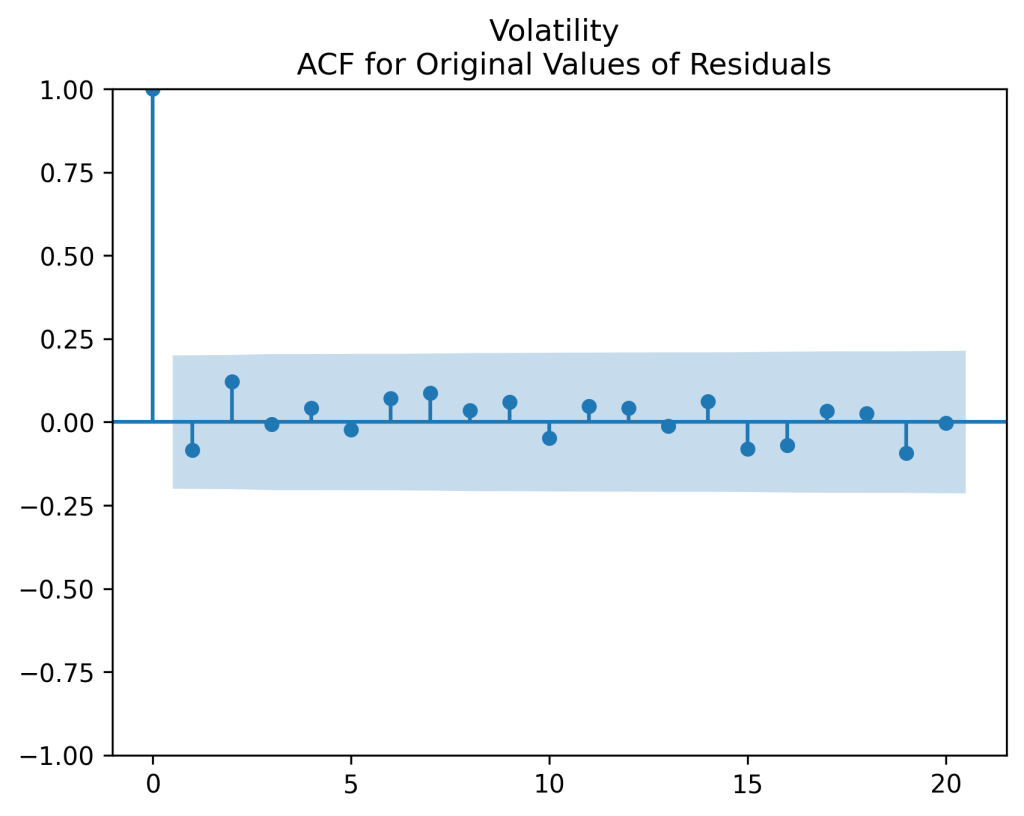

Now let us analyze residuals (innovations) which are supposed to be independent identically distributed mean-zero Gaussian:

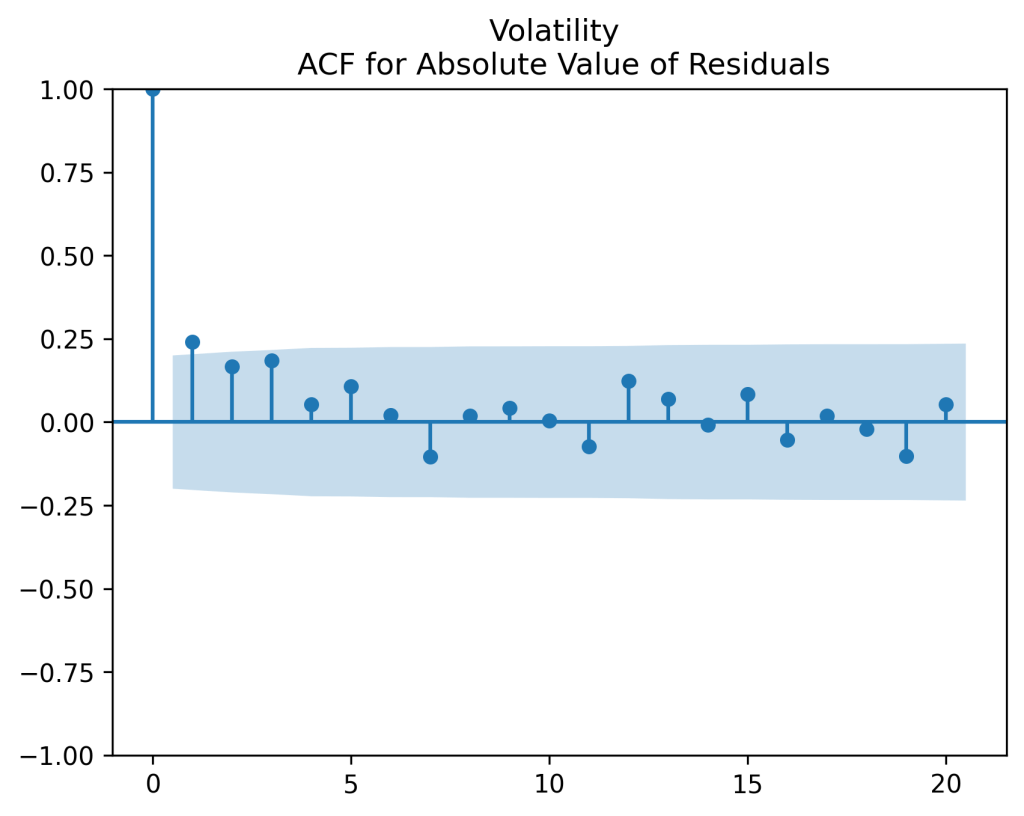

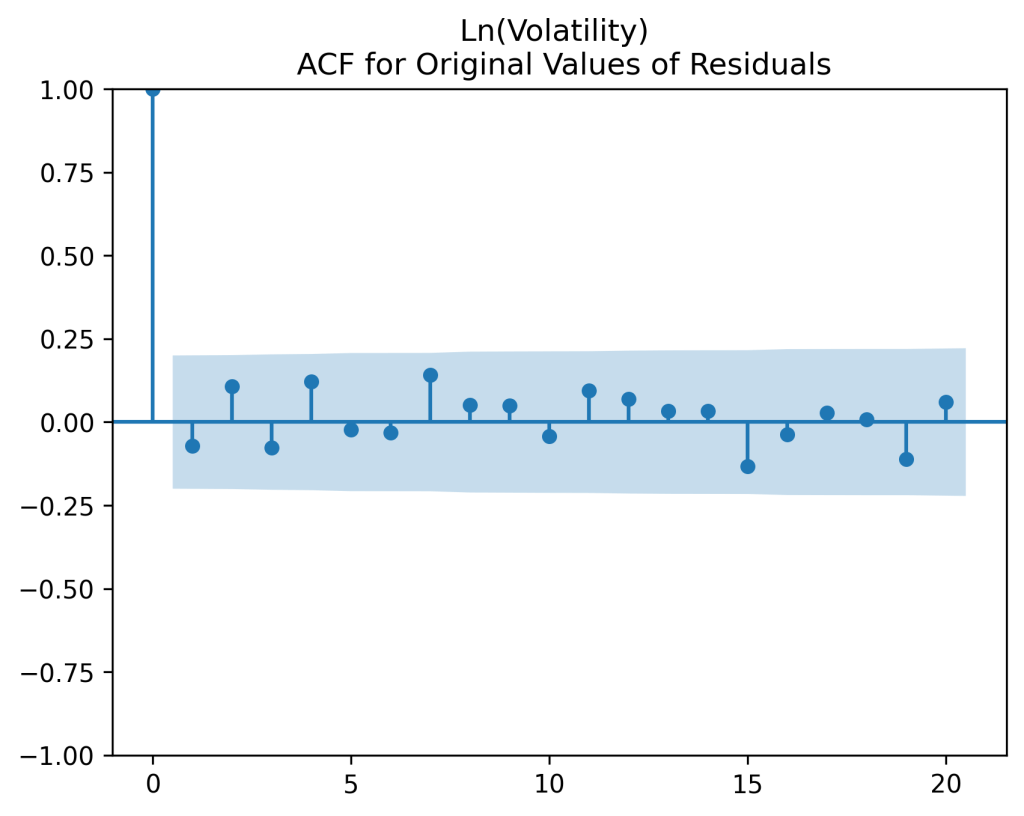

Angel did this by making the autocorrelation function plots for

and for

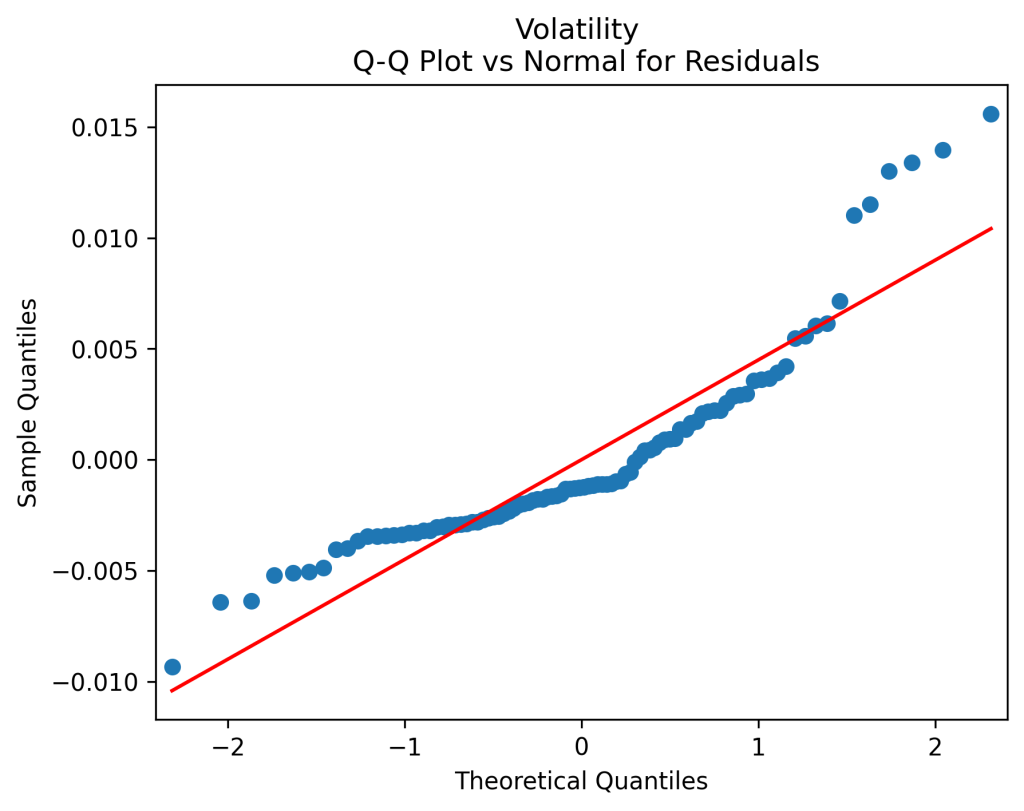

, as well as the quantile-quantile plot of

versus the normal distribution:

We see that the ACF plot for corresponds to white noise but the ACF plot for

does not. A few first lags have significant autocorrelation. Less importantly but also unfortunately, the quantile-quantile plot shows the innovations

are not Gaussian.

Yet another problem with this Heston model: Volatility can go negative according to this model, but this is impossible in real life. As a standard deviation of market fluctuations, volatility is always supposed to stay positive.

Next, Angel modeled the resulting series as an autoregression of order 1 on the logarithmic scale:

For updated data, and

so there is mean-reversion. She did not test for unit root but I am very sure this hypothesis (that

) would be rejected.

See the autocorrelation function plots for innovations and for their absolute values

which show these

can be modeled as independent identically distributed. And the quantile-quantile plot versus the normal distribution shows these are Gaussian.

The resulting stationary distribution is Gaussian with mean -4.68 and variance 0.218. Using the moment generating function for the normal distribution, we can compute

and variance

Updated data for 1928-2024 volatility, nominal and real returns, and index prices, can be found on my web site

The code and data for the current post can be found on https://github.com/asarantsev/Annual-Volatility

Leave a reply to Updated Simulator for Rate and Volatility – My Finance Cancel reply