My undergraduate student Angel Piotrowski computed annual volatility for Standard & Poor 500 (and its predecessor, Standard & Poor 90). For each year 1928 — 2023, she took daily index values with day

in this year, and computed log returns

Then she computed standard deviation of these log returns for day

in any given year. Let

be this standard deviation, usually called volatility, for year

The data is available on my web page.

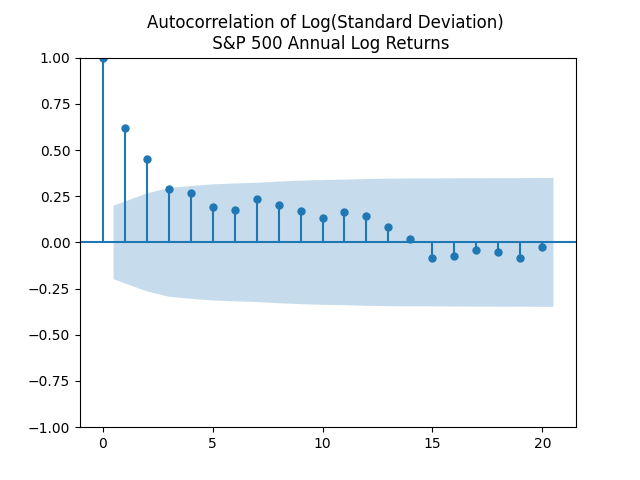

Next, Angel created a time series model for this volatility: Autoregression of order 1 on the log scale. The motivation comes from plotting the autocorrelation function for It is defined as

This looks like an autocorrelation function for an autoregression of order 1.

Here is the equation for this autoregression: with

and

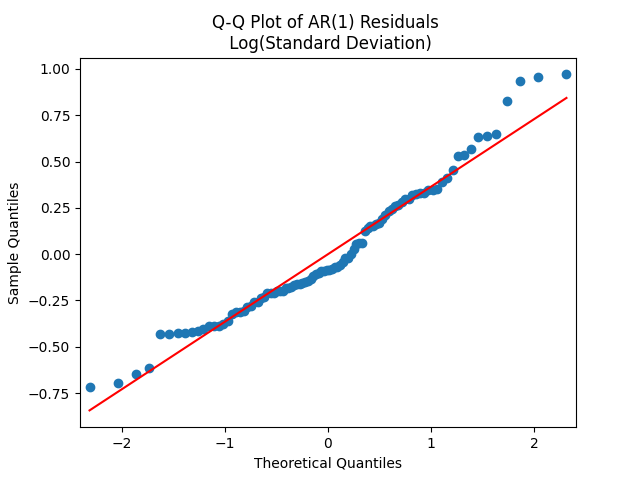

Let us test whether the innovations

are Gaussian. Apply the quantile-quantile plot versus the normal distribution. This looks like pretty close to a Gaussian law!

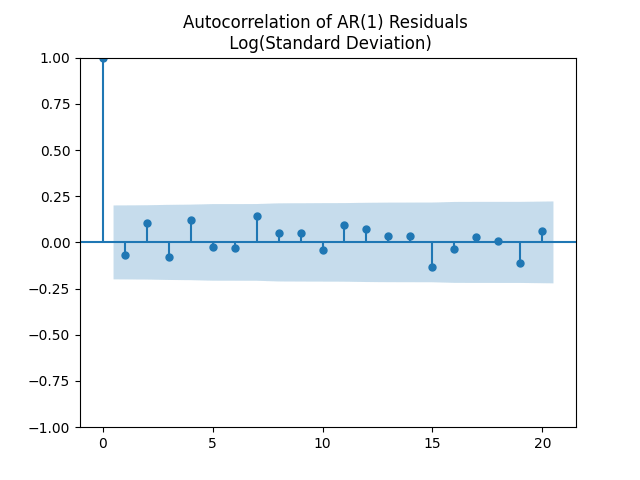

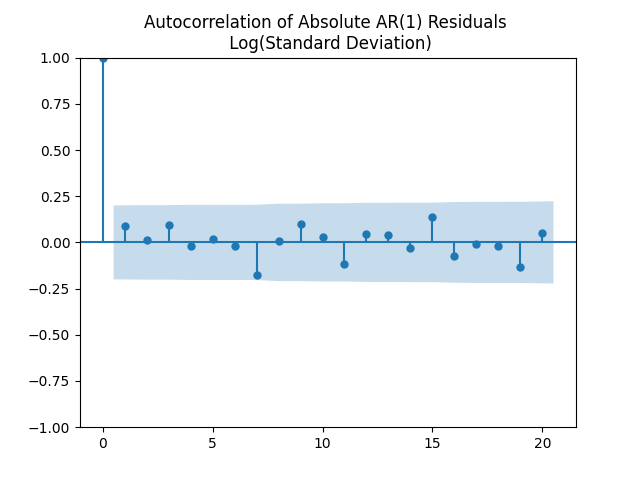

Next, plot the autocorrelation function for innovations and another plot of an autocorrelation function for their absolute values

to see that they correspond to white noise.

Thus the model fits well: We have numerical estimates

Therefore, this autoregression has a stationary distribution, or an invariant probability measure,

such that

Angel has computed that mean and variance of this stationary distribution.

Leave a comment