I updated the web site Financial Simulator and the local version on GitHub/asarantsev repository annual-simulator. I corrected the following mistakes:

- Innovations are simulated as multivariate Gaussian, since the kernel density estimator does only independent components in the multivariate case, but we do need correlated innovation series. This is very important, since independent innovations imply higher returns. The true innovations are negatively correlated. I will write more on this in the future.

- I made sure volatility from the current year not the previous year is used to model total returns. Unfortunately, I made a misprint in previous simulators. This mistake led to independent innovations instead of negatively correlated innovations.

- I removed any ability to change initial conditions, instead taking just the current conditions (volatility). I also removed any ability to change how to simulate innovations (kernel density estimation or multivariate Gaussian distribution).

Unfortunately, I made the same mistake in my other simulators.

Let me mention that I also made colored background of the plot, the legend, and the input fields. They all have different colors. Finally, I removed any references to myself and model description, because I wished to save space. I do not think usual users will be interested in this. This is only the simplest model with volatility as factor only.

TO DO LIST

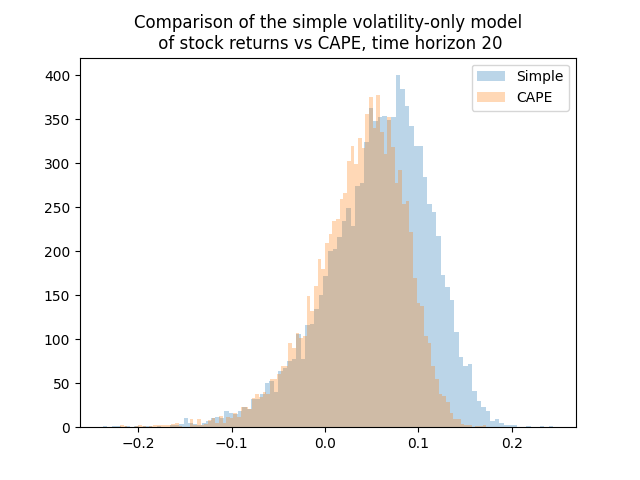

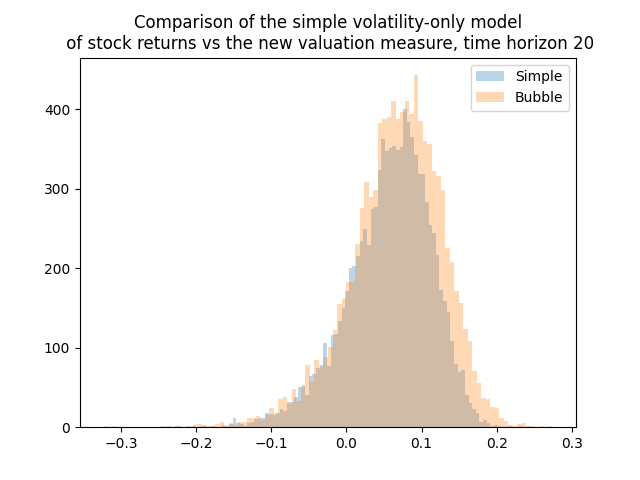

- I was thinking whether adding other factors such as the new valuation measure or bond spreads changes the distribution of average total returns or terminal wealth. Because this is the only thing we are interested in. Update: See below for comparison of the simple model, CAPE, and the new valuation measure. Yes, including earnings using CAPE or the bubble measure makes a huge difference. For current CAPE, future total returns will be lower, because CAPE is way higher than the historical average. For the new bubble (valuation) measure, the opposite is true.

- Use Gaussian vs Laplace innovations for autoregression of log volatility. Does this change the said distributions? If yes, we need to take care, and do kernel density estimation by hand. Volatility autoregression innovations are not Gaussian.

- Need to correct these misprints in the other simulators with more complicated models.

Leave a reply to To Do List – My Finance Cancel reply