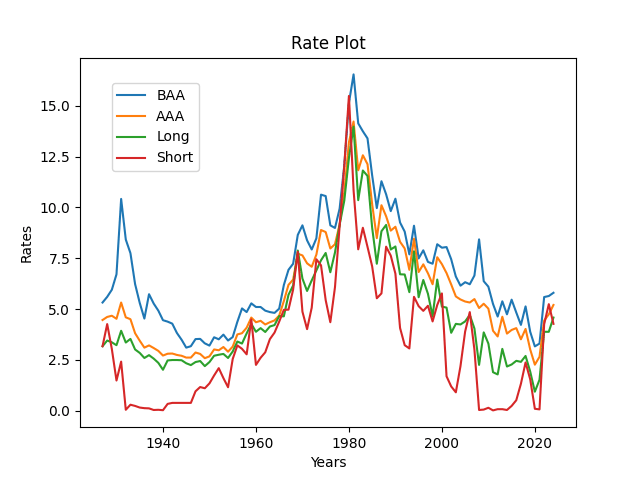

Data description: This research is an improvement of Ian Anderson’s research. See GitHub/asarantsev repository 4rates, which contains Python code, Excel data, and all generated pictures. We take four series of USA bond rates, annual end-of-year (December, monthly average) data:

- Short: 3-6 month government yields 1927-1933, 3-month 1934-now

- Long: long-term government yields 1927-1963, 10-year 1964-now

- AAA Moody’s

- BAA Moody’s

We need to take this because this is an improvement over existing Robert Shiller’s data: Hard to find long and short-term interest rates. Also, Robert Shiller’s data is average January, and our data is December. But to model next year’s stock returns, we need the data we know by the end of this year: Thus we need December, not January.

Statistical Methodology: For each series, we fit an autoregression of order 1: We analyze innovations

for Gaussian IID. Next, we divide

for annual volatility

available for 1928-2024, and analyze

for Gaussian IID.

Analysis for Gaussian IID is performed as follows:

- Skewness (with Gaussian = 0)

- Kurtosis (with Gaussian = 0)

- Shapiro-Wilk normality test

- Jarque-Bera normality test

- Quantile-quantile plot versus the normal distribution

- L1 norm for autocorrelation function for original values, 5 lags

- L1 norm for autocorrelation function for absolute values, 5 lags

- Autocorrelation function plot for original values

- Autocorrelation function plot for absolute values

For items 1, 2, 6, 7, we use the Monte Carlo simulations giving us 95% and 99% percentiles. This allows us to make normality tests and white noise tests.

Analysis of rates: We summarize results in the table below. The sign XXXXX shows we have independent identically distributed Gaussian innovations. If we have only one of two features: Gaussian but not independent identically distributed, or vice versa, we show it. The term Success means Independent identically distributed Gaussian.

| Rate | Original innovations | Normalized innovations |

| BAA | Independent identically distributed | XXXXX |

| AAA | XXXXX | XXXXX |

| Long | XXXXX | XXXXX |

| Short | XXXXX | XXXXX |

Thus we can use autoregression only for BAA rates: Here the

for the Student T-test. Here

are independent identically distributed but not Gaussian.

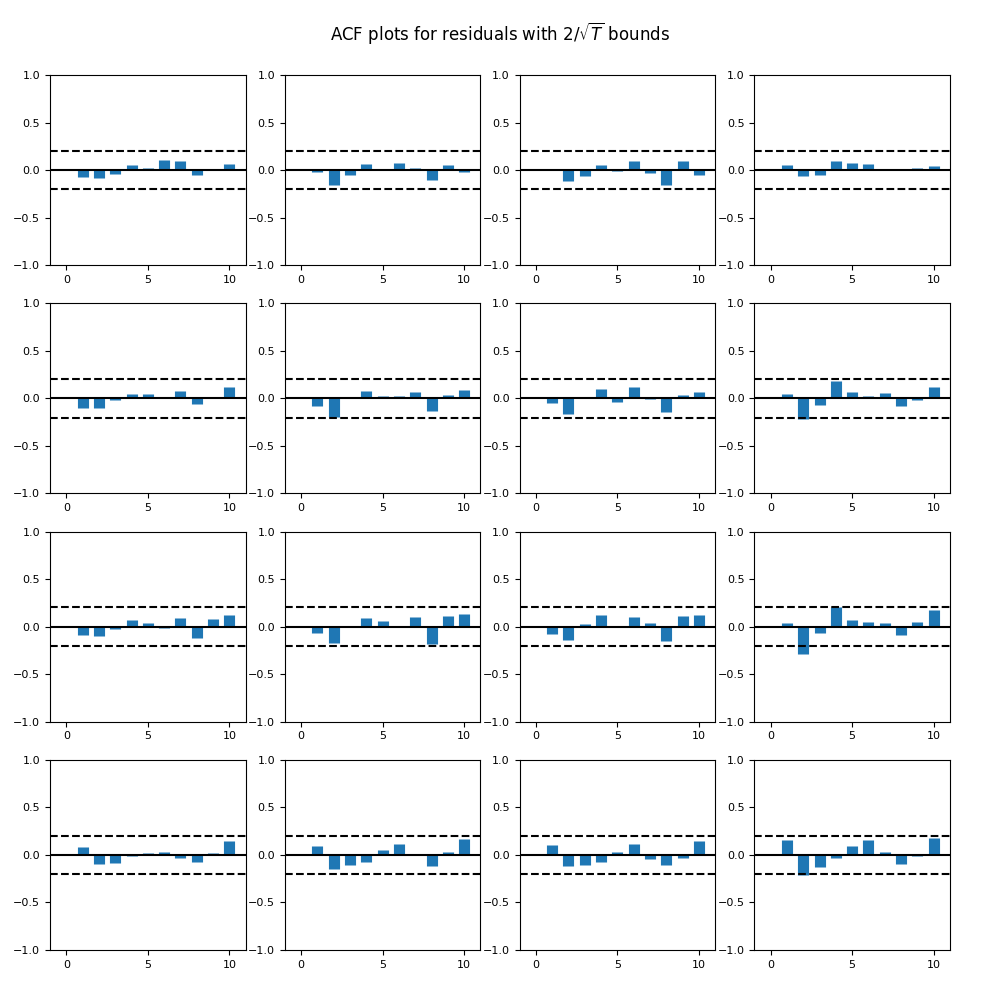

Also, we apply the vector autoregression of order 1 for the vector of all four rates. Then we apply the same analysis to each of the four series of innovations. Unfortunately but not surprising, we have complete failure for all innovations. First, we present the autocorrelation and cross-correlation function plots for these four series.

Seems like all plots correspond to white noise. But plots of absolute values of innovations show our failure. We summarize:

| Rate | Original innovations | Normalized innovations |

| BAA | Independent identically distributed | Independent identically distributed |

| AAA | XXXXX | XXXXX |

| Long | Gaussian | XXXXX |

| Short | XXXXX | XXXXX |

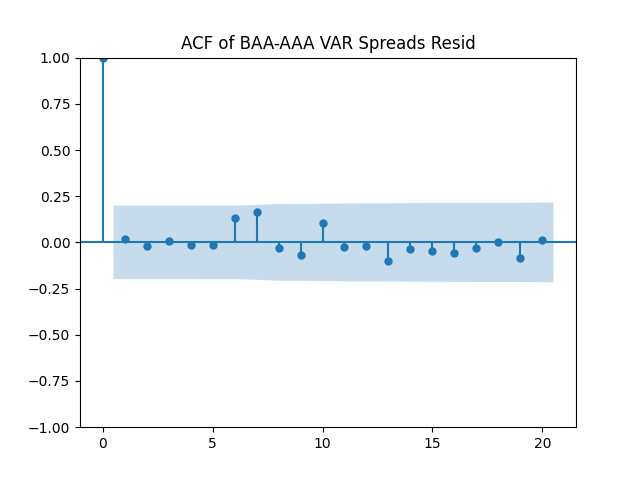

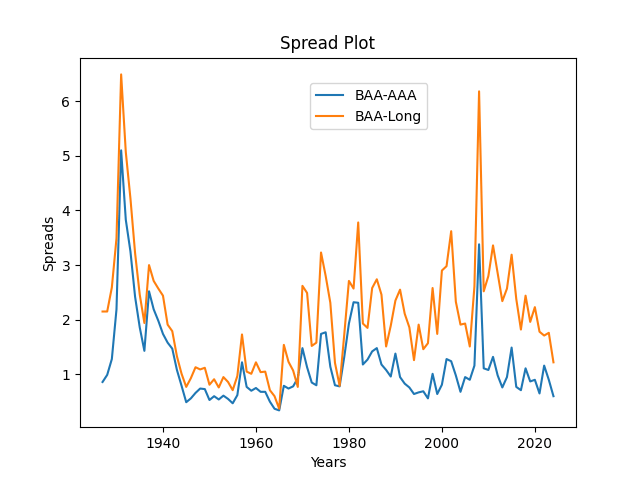

Bond spreads: Finally, we do the same analysis for spreads. There are six series of spreads.

| Spread | Original innovations | Normalized innovations |

| BAA-AAA | Independent identically distributed | Success |

| AAA-Long | Independent identically distributed | Gaussian |

| Long-Short | Independent identically distributed | XXXXX |

| BAA-Long | Independent identically distributed | Success |

| BAA-Short | Independent identically distributed | XXXXX |

| AAA-Short | XXXXX | XXXXX |

Let us write autoregression for BAA-AAA, AAA-Long and BAA-Long (all Student p-values are very small):

BAA-AAA: and

AAA-Long: and

BAA-Long and

Vector autoregression for two spreads BAA-AAA, BAA-Long: We write vector autoregression for bivariate series which is BAA-AAA, BAA-Long:

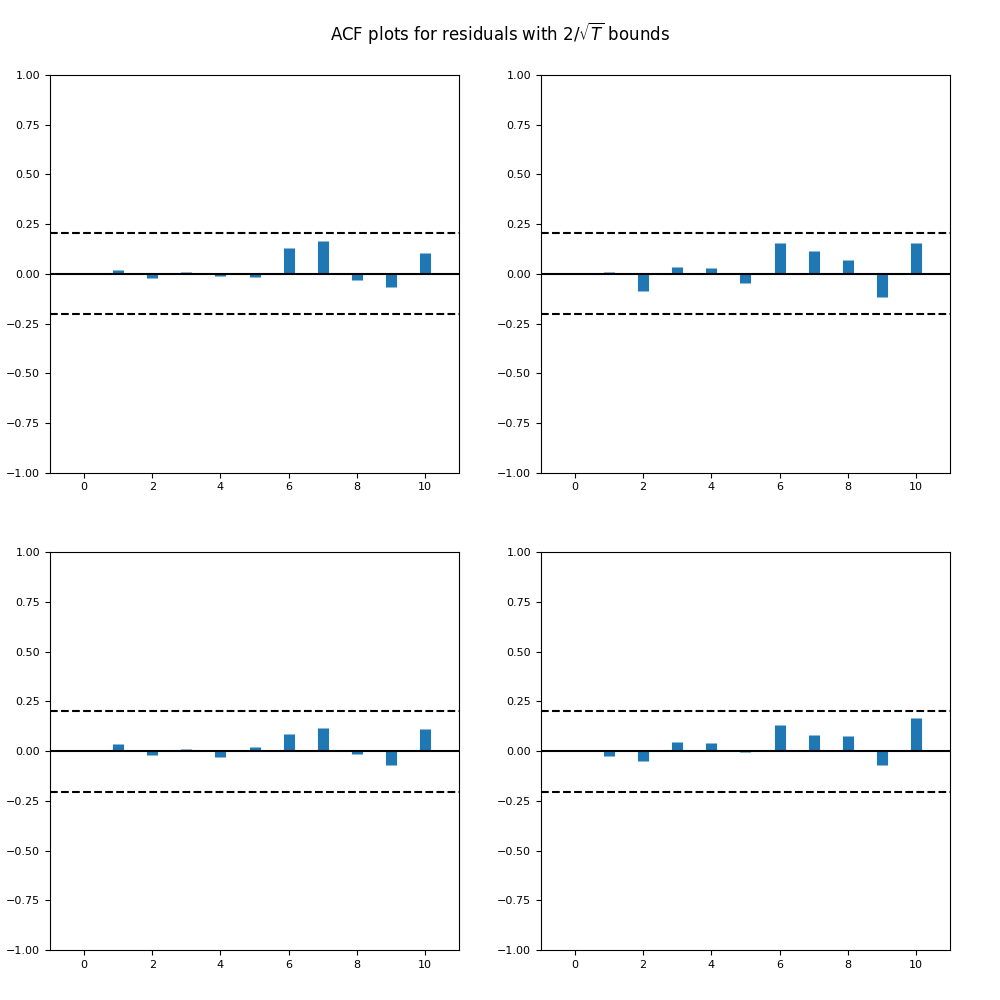

Overall, it seems reasonable for us to model as independent identically distributed. See below the autocorrelation and cross-correlation plots. The correlation of its two components is 89%.

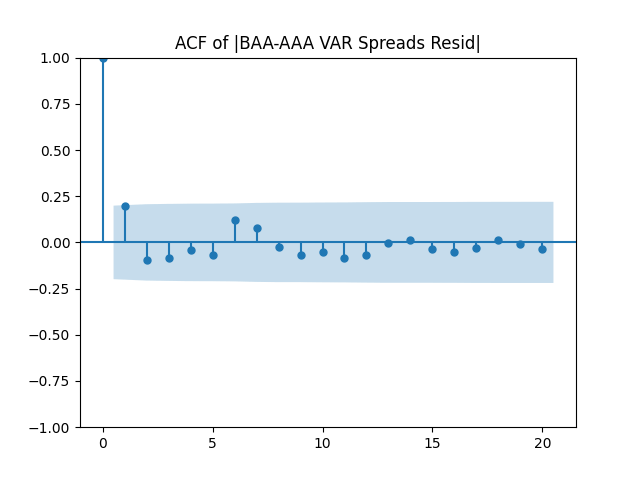

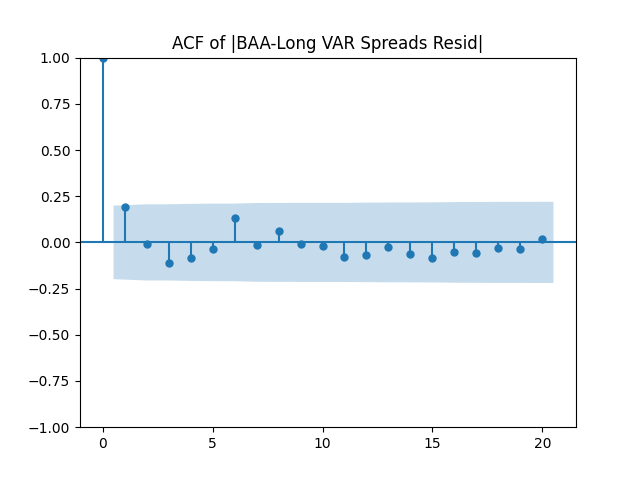

Below see plots for the first series of residuals before normalization: the quantile-quantile plot versus the normal distribution; the autocorrelation function for

; the autocorrelation function for

We see it is reasonable to model

as independent identically distributed but not Gaussian.

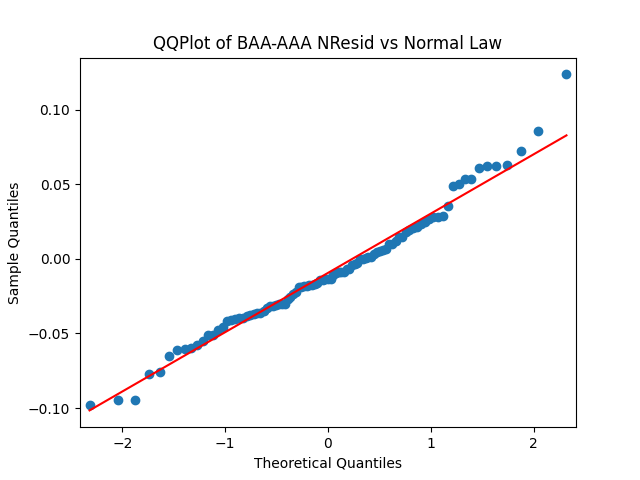

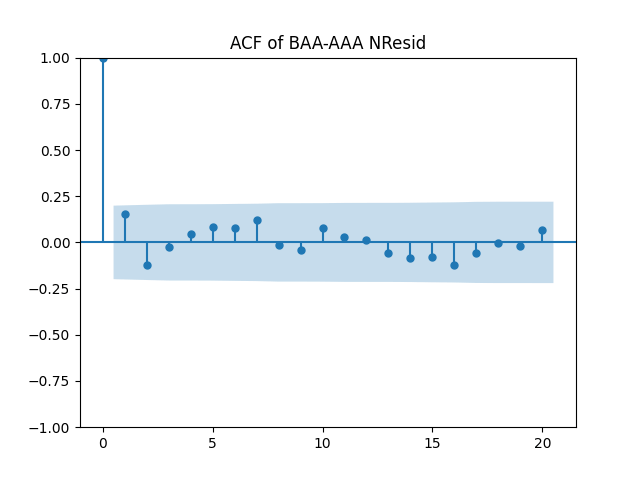

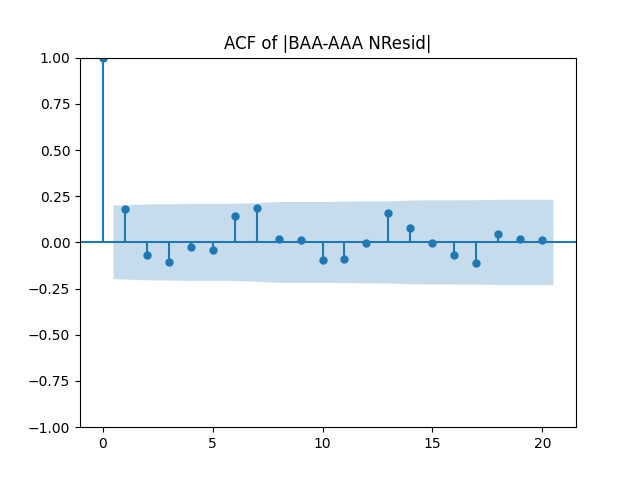

Next, we normalize these residuals by dividing them by and make the three plots for

We see it is reasonable to model

as independent identically distributed normal.

Similar results are true for . Make the three plots for this second series of residuals.

And make the same plots after division by

Conclusion. We can model [BAA-AAA, BAA-Long] as bivariate mean-reverting vector autoregression of order 1 with bivariate Gaussian innovations. All other rates and spreads do not allow autoregression modeling with Gaussian innovations.

Of course, the spread between BAA rates and AAA rates is smaller than between BAA rates and long-term Treasury rates.

Leave a reply to Earnings Yield, 3 Bond Spreads, Annual Returns – My Finance Cancel reply