My undergraduate student Angel Piotrowski continued her work, started with annual volatility 1928-2023. First, she updated the annual realized volatility for 2024. The resulting series 1928-2024 is still well modeled by log Heston model, see another post. The research in this post is done in GitHub/asarantsev repository.

Then she computed annual returns of S&P 500 (and its predecessor, S&P 90) 1928-2024 in four versions:

- nominal (not adjusted for inflation) or real (adjusted for inflation);

- price (due only to price changes) or total (including dividends paid).

We take nominal annual dividend: and December Consumer Price Index

We take the price

at the close of the last trading day of the year

. Price returns are computed as

and total returns are

for nominal versions. But for real versions, we need to subtract

from each of these. You see that all returns are logarithmic (geometric), so there is no problem of compound interest. If wealth at end of year

is

then

where

is returns during year

.

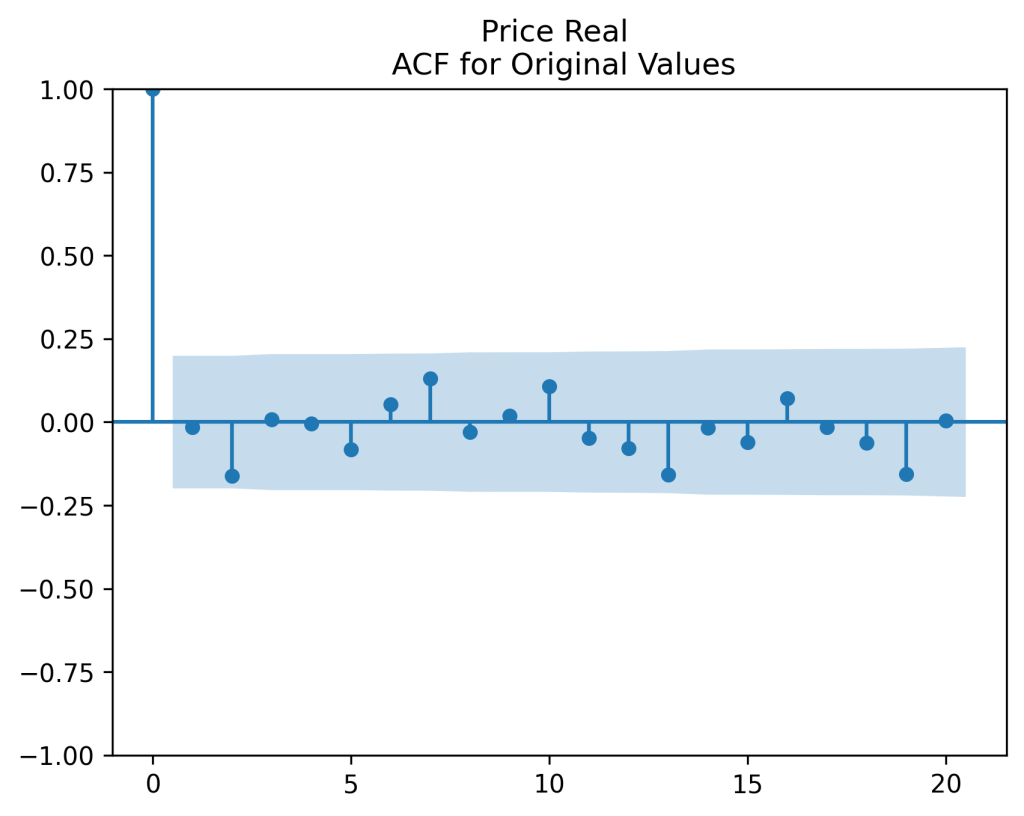

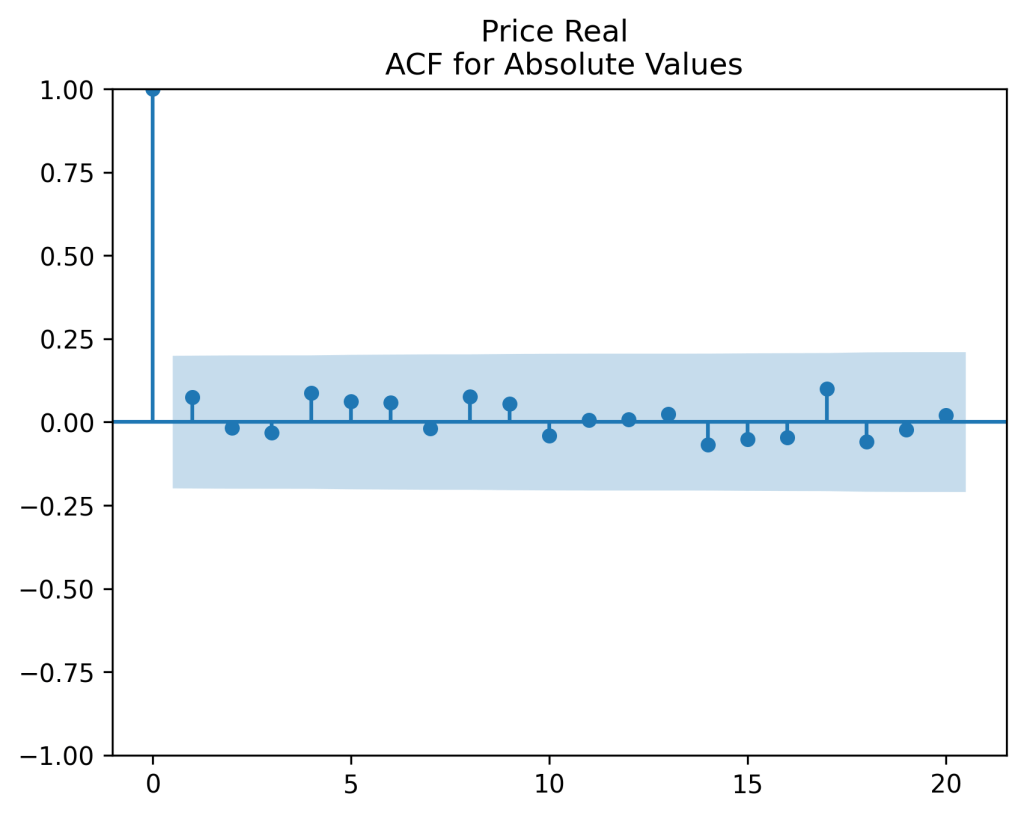

In each of these four cases, returns are IID but not normal. However, dividing them by volatility keeps them IID but makes them normal. Just to illustrate, let us take real price returns

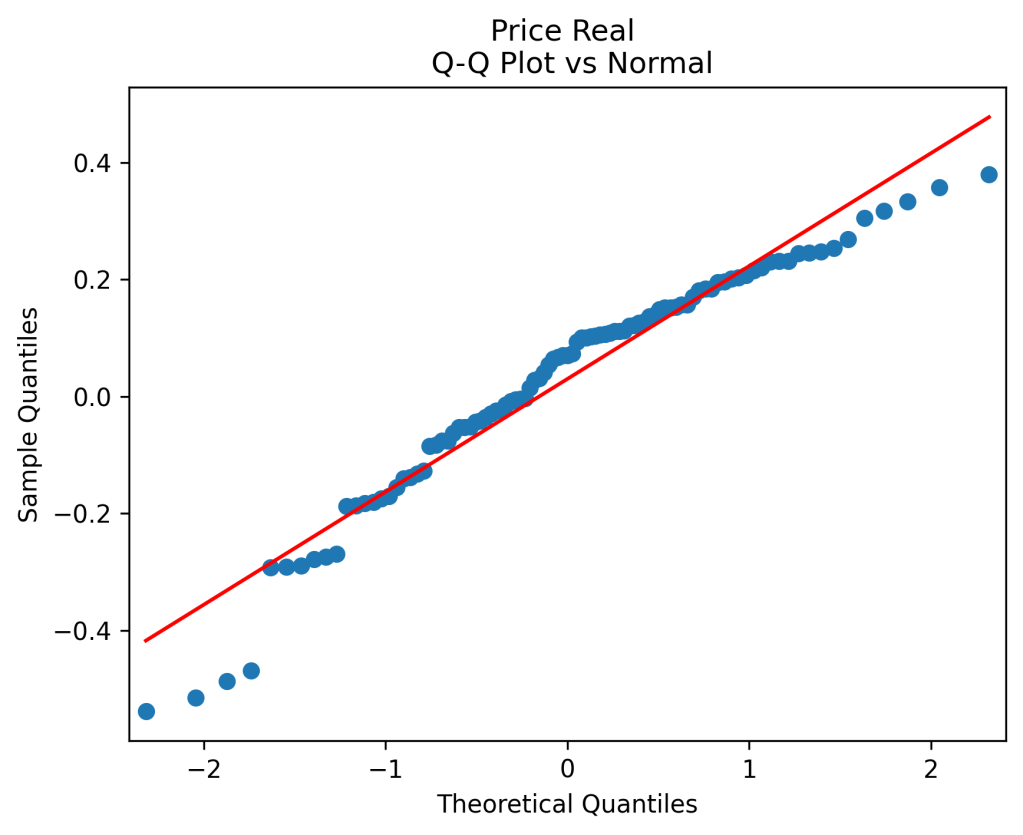

The autocorrelation function for (left panel) and for

(right panel) show these are close to zero. So it is reasonable to model these as independent identically distributed random variables. However, the below quantile-quantile plot versus the normal distribution shows these are not normal.

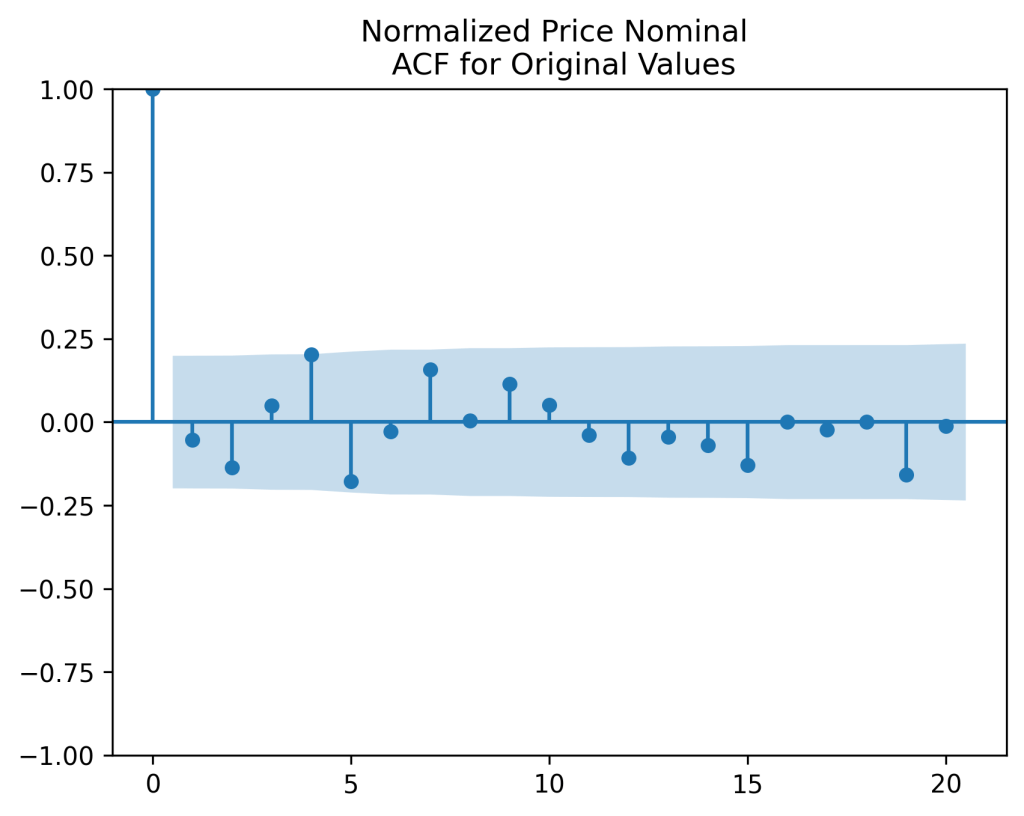

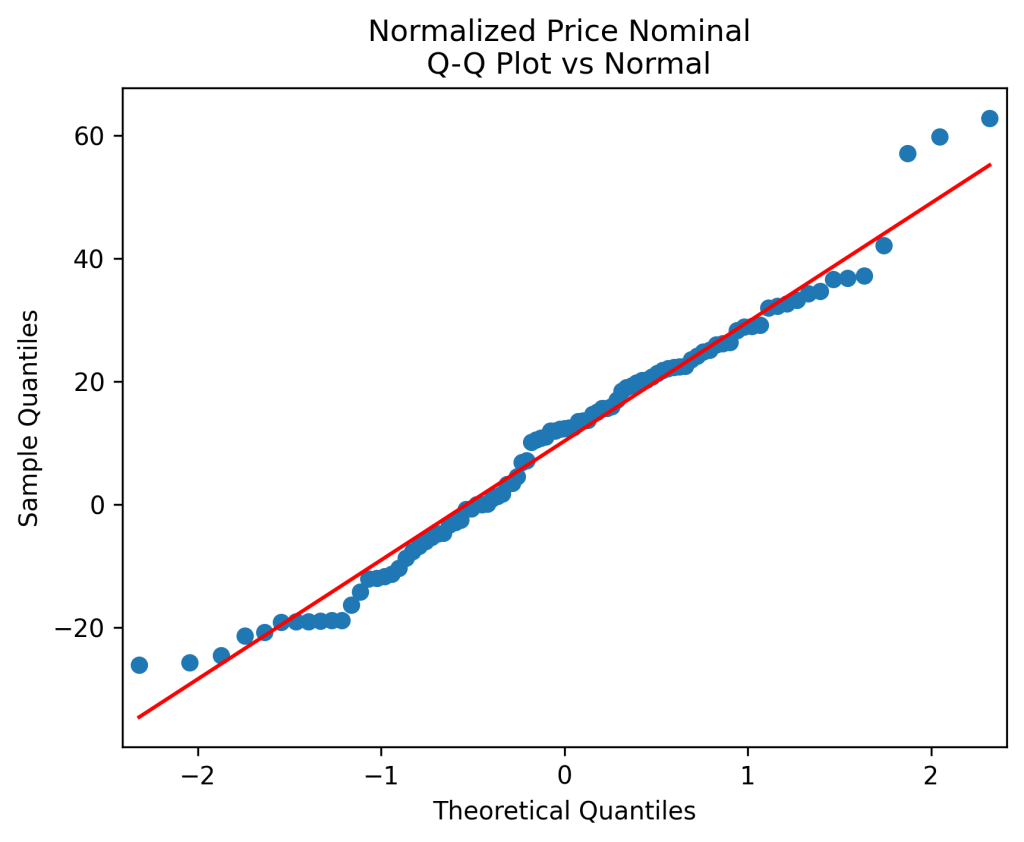

Next, repeat this analysis for normalized

And see that are also well modeled as independent identically distributed. But unlike the previous example, the quantile-quantile plot shows that

is Gaussian:

This is confirmed by results of two statistical tests for normality: Shapiro-Wilk and Jarque-Bera. See their -values below. One can clearly see we reject normality hypothesis for original but not normalized returns, for all four versions of returns, and for each of two tests.

| Returns | Original Total Real | Normd Total Real | Original Total Nominal | Normd Total Nominal | Original Price Real | Normd Price Real | Original Price Nominal | Normd Price Nominal |

| Shapiro-Wilk p | 0.00164 | 20% | 0.00027 | 11% | 0.00087 | 28% | 0.00009 | 11% |

| Jarque-Bera p | 0.00627 | 63% | 0.00005 | 60% | 0.00217 | 86% | 0.00000 | 60% |

Leave a reply to Updated Simulator for Rate and Volatility – My Finance Cancel reply