This work is of my undergraduate student Ian Anderson using the annual January data for American bond rate spreads. It uses annual volatility data complied by my other undergraduate student Angel Piotrowski. See the previous post.

Consider the spread between 10-year Treasury rate and 1-year Treasury rate. Usually, long-term rates are higher than short-term rates, since investors want extra compensation for committing their money for a long time. Another way to express this is that long-term bonds are more exposed to interest rate risk: If bond rates rise then bond prices fall. The coefficient is called the duration, and it is higher for long-term bonds.

But sometimes, long-term rates are lower than short-term rates. This is usually not a good sign, and a harbinger of a recession. Expecting a recession soon, investors anticipate short-term interest rate cuts by the Federal Reserve. This influences current long-term rates, which incorporate current and expected future short-term rates.

Denote this spread by Apply an autoregression of order 1:

We expect mean reversion for this spread, which is true for

This is different from

where this process is a random walk, when future movements are independent of the past.

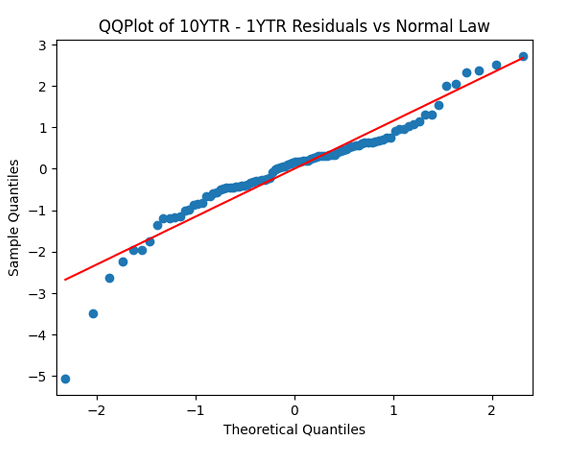

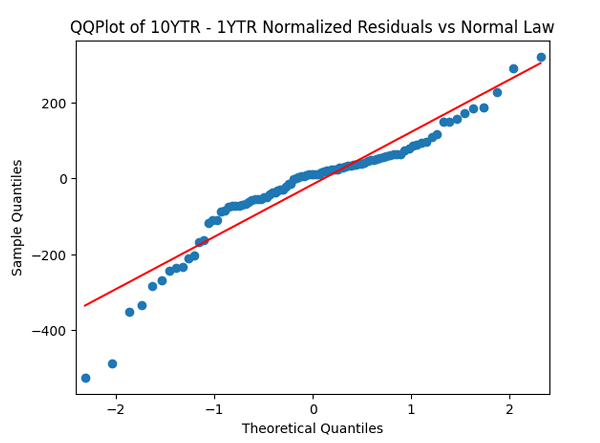

Let us now analyze the innovations, otherwise called regression residuals: Apply the quantile-quantile plot versus the normal distribution. Next, divide these innovations by annual volatility and make the quantile-quantile plot again.

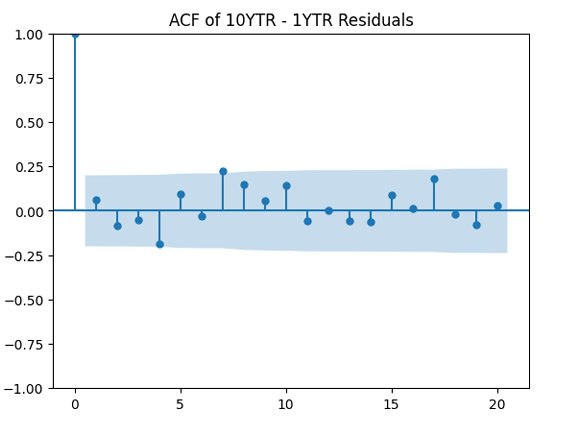

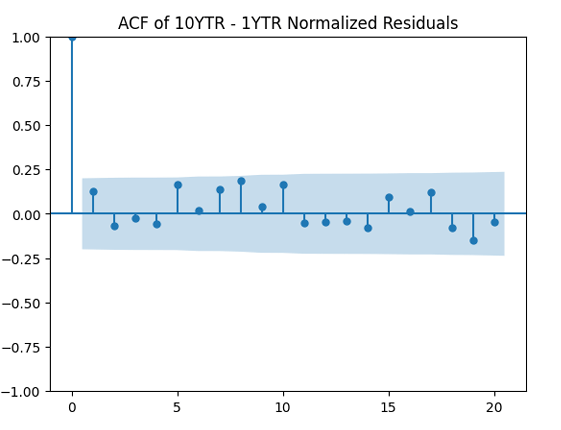

We do not see much difference… Does not seem to be normal. But let us apply the autocorrelation function to these innovations Next, divide by the volatility and plot the autocorrelation function again, now for

Both plots seem to be for white noise, no autocorrelation.

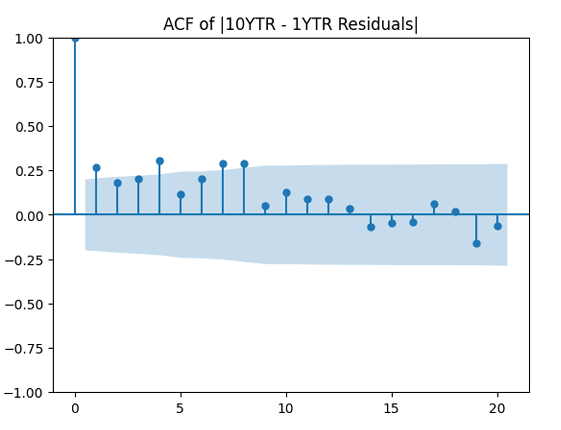

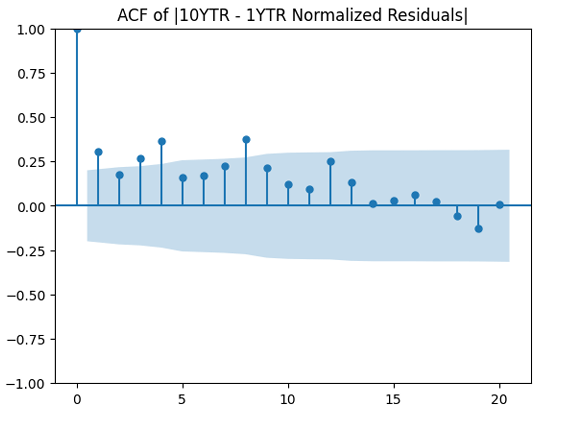

Finally, apply the autocorrelation function to the absolute value and see whether it is truly independent? It is not. Next, divide by volatility and apply the autocorrelation function to

to see whether it improves the result. It does not, in fact!

But now let us fit the same for the bond spread between AAA Moody’s rate and 10-year Treasury rate. The AAA rating is the highest reserved for corporate and municipal bonds, which have the lowest default risk.

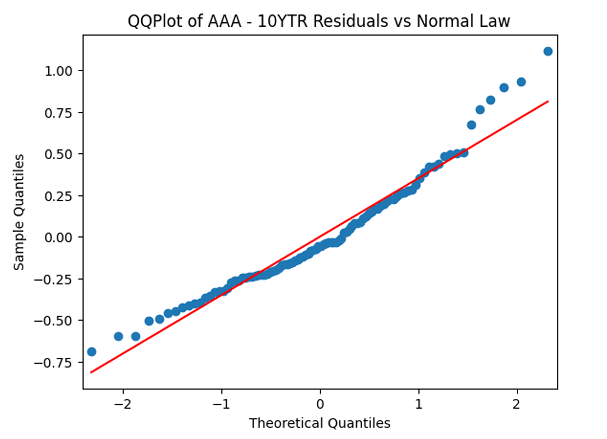

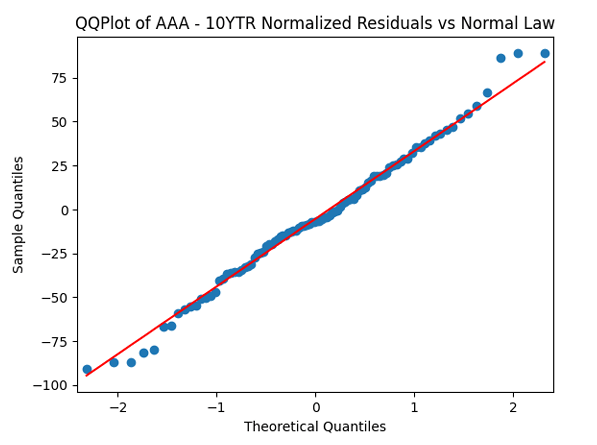

QQ plot of innovations before normalization, close to normal but not quite. QQ plot of innovations after normalizations: Much closer to normal!

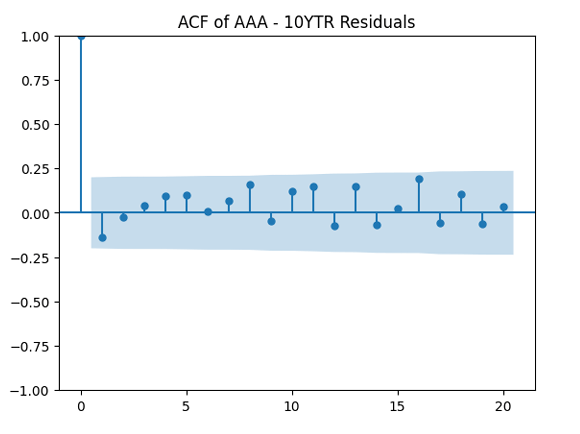

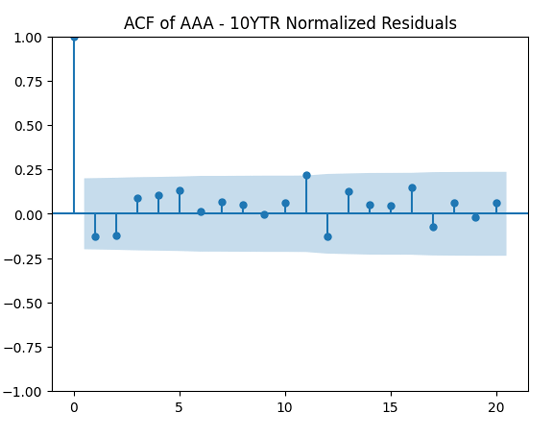

Autocorrelation function for innovations before and after normalizing: Good!

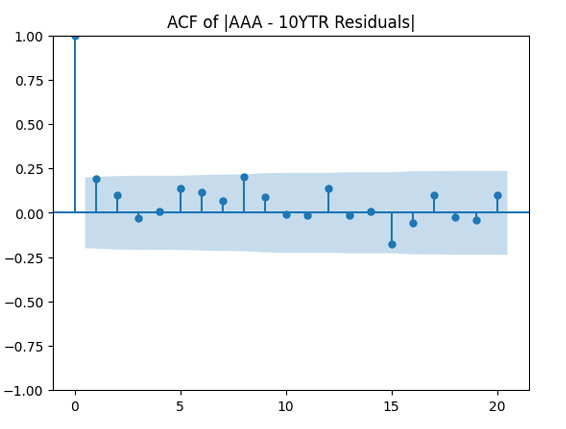

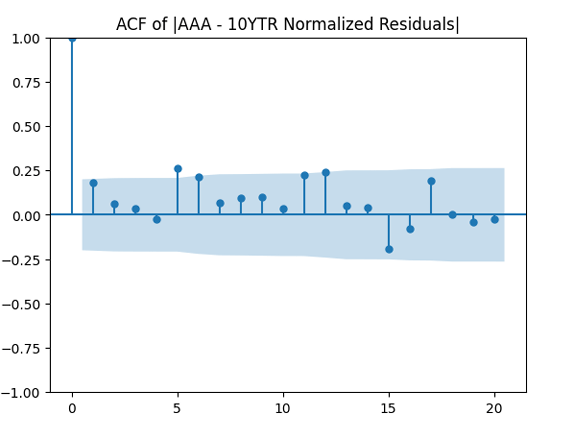

Autocorrelation function for absolute values of innovations before and after normalizing: Not so good, but acceptable. We need some further white noise testing.

The AAA-1YTR spread results are the same as for 10YTR-1YTR. Here TR stands for Treasury Rate.

Thus, the answer to the question in the title: Using volatility improves autoregression of order 1 for credit risk spread AAA-10YTR but not for long-short term spread 10YTR-1YTR and not for combined spread AAA-1YTR.

Leave a reply to Financial Simulator, Current Version – My Finance Cancel reply