This work was done by my undergraduate student Ian Anderson, using the volatility data computed by my other undergraduate student Angel Piotrowski, see the previous post.

Ian took 1927-2023 net earnings of Standard & Poor 500 (since 1957; or its predecessor Standard & Poor 90) and compute annual growth

We do this first for nominal earnings, without adjustment for inflation. We analyze

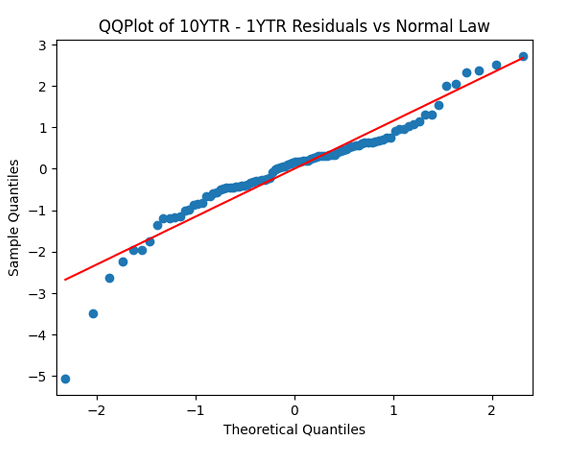

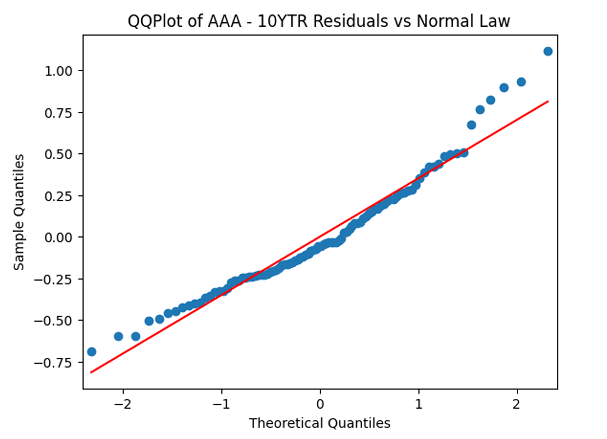

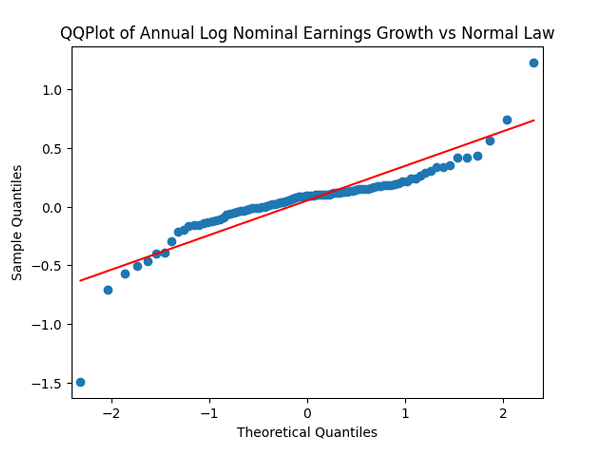

whether it is Gaussian independent identically distributed. We make the quantile-quantile (QQ) plot versus the normal distribution.

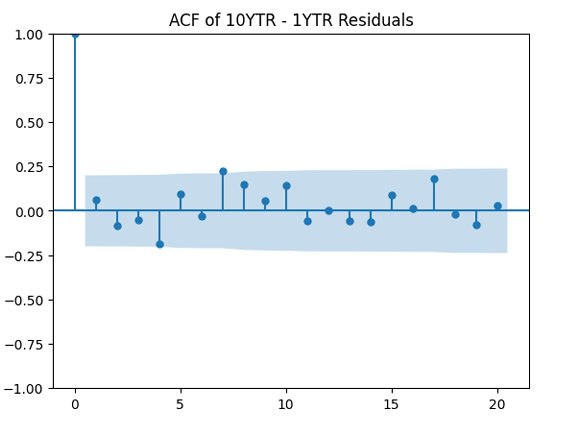

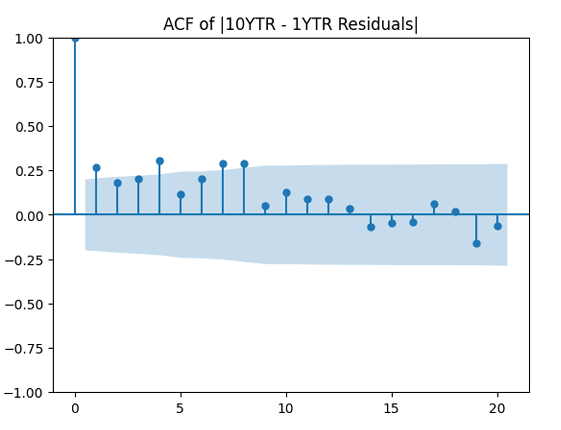

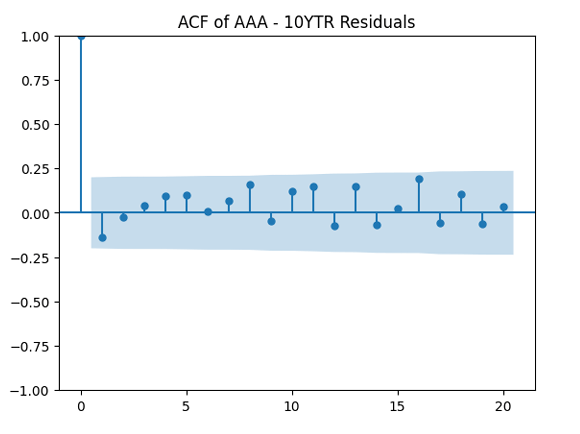

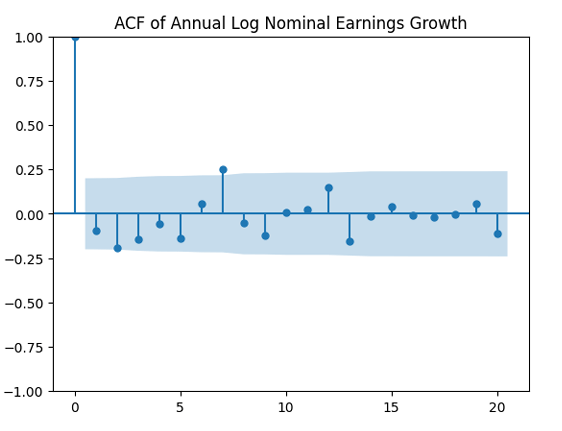

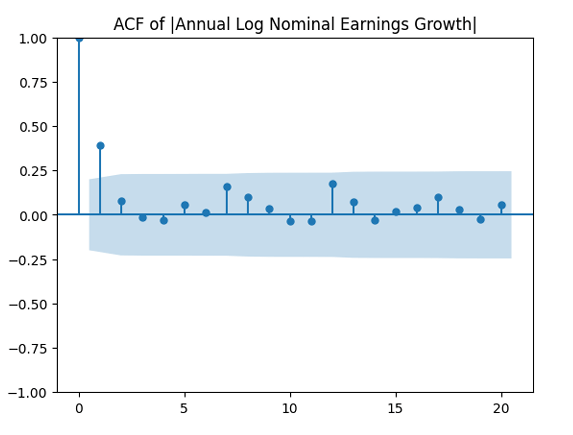

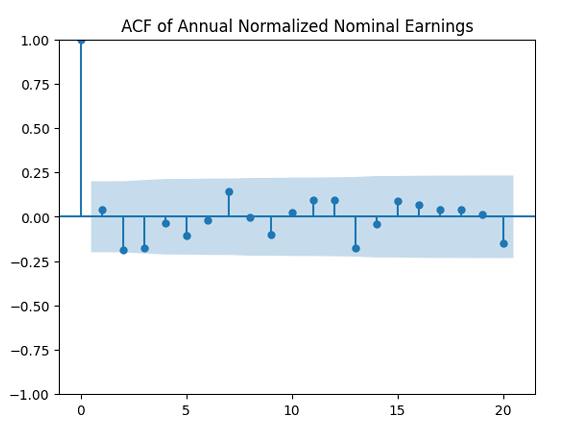

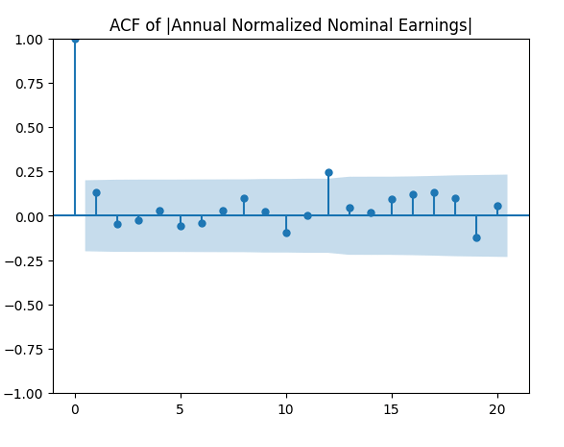

And we plot the autocorrelation function for and another plot for the autocorrelation function for

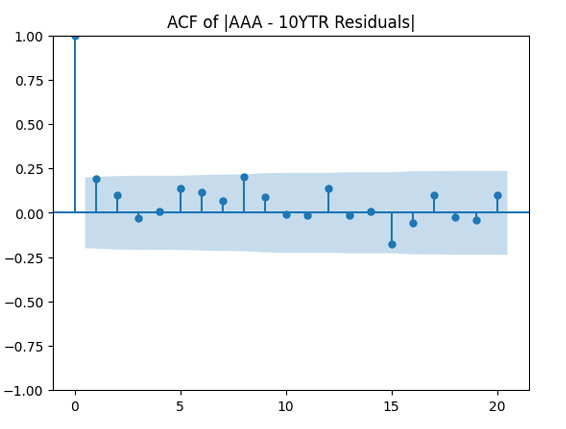

We see from the QQ plot that, unfortunately, earnings growth terms are not Gaussian. The autocorrelation function for earnings growth corresponds to white noise: It shows that and

are uncorrelated. But with absolute values, this is not true. There is a significant autocorrelation of lag 1:

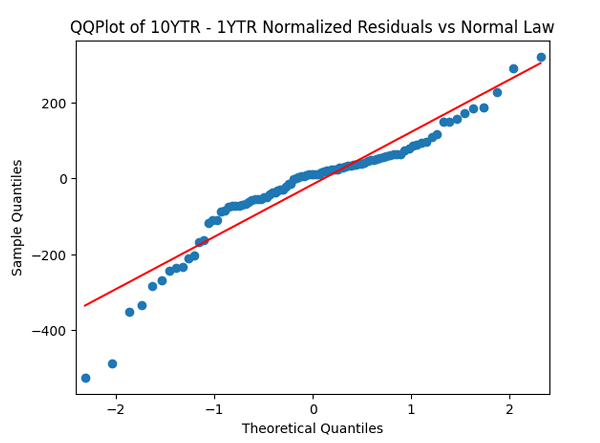

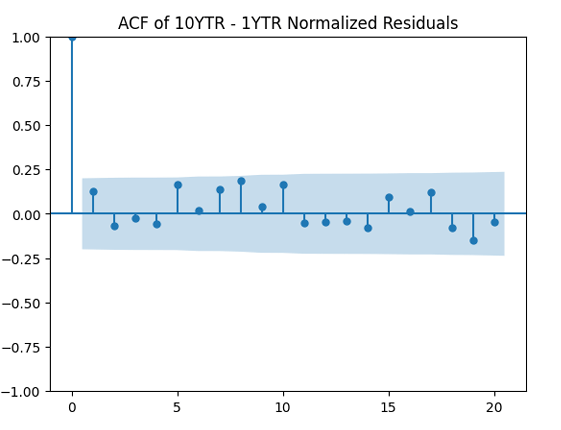

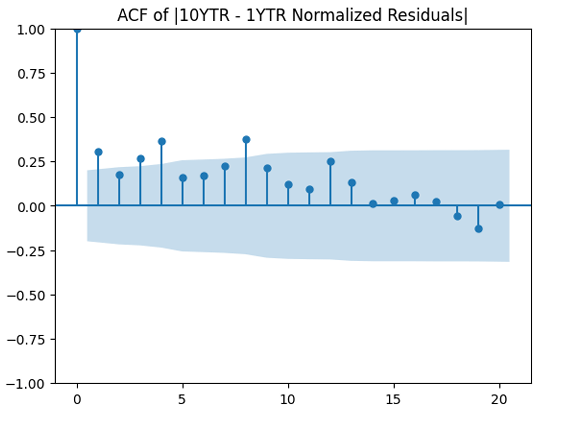

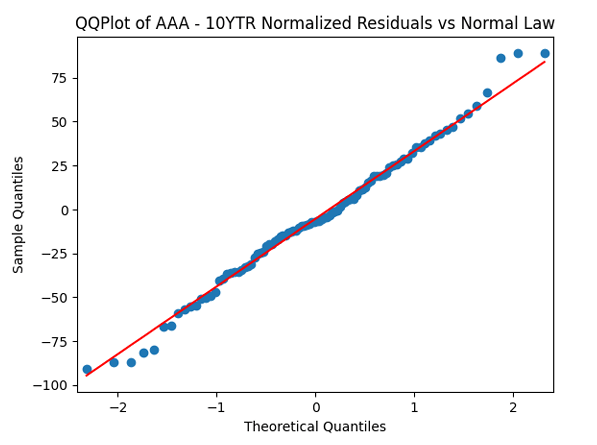

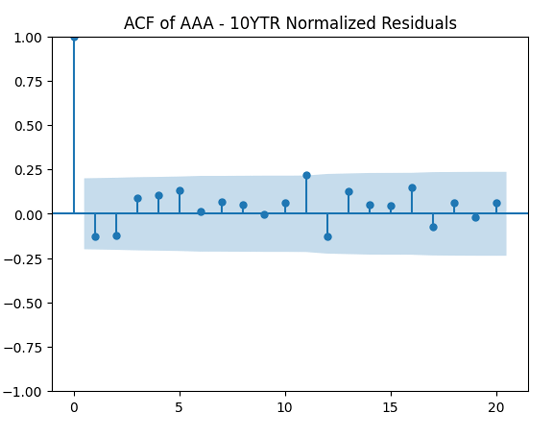

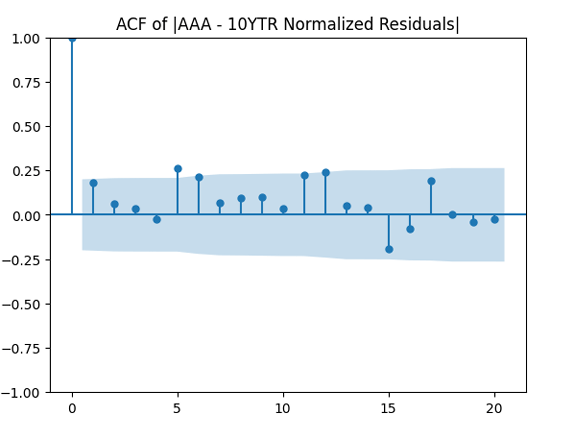

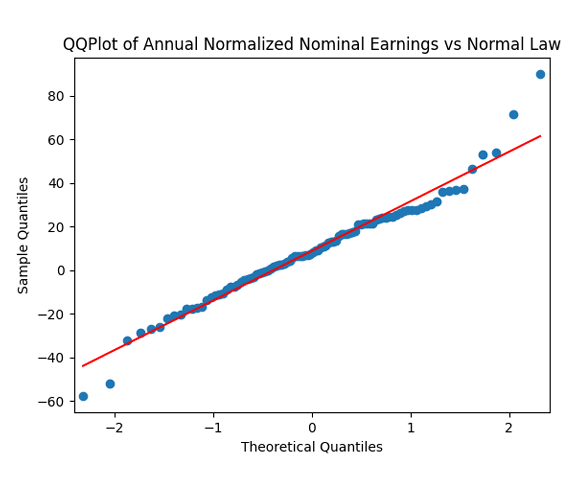

Then divide the earnings growth by annual volatility and get Does this division improve these terms to make them closer to Gaussian independent identically distributed? In fact, yes!

We see that now both autocorrelation plots show lack of significant autocorrelations. And the quantile-quantile plot is much closer to linear. Thus it makes sense to model as independent identically distributed Gaussian.

The same happens if we consider real earnings (inflation-adjusted) instead of nominal earnings, using December data for the Consumer Price Index. Thus we have joint model for earnings and volatility, annual 1927-2023:

are independent identically distributed bivariate normal, with mean zero and covariance 2×2 matrix

This works for both nominal and real annual earnings, but not for dividends.