In the repository https://github.com/asarantsev/advanced we added another page with advanced version of the simulator, where we can pick initial conditions for model factors:

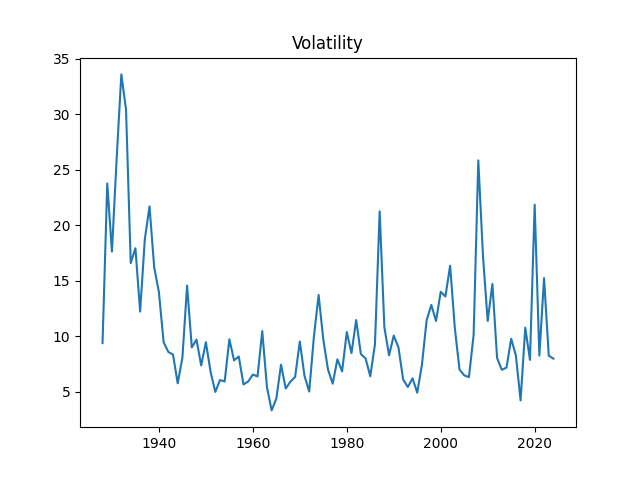

- S&P 500 Annual Volatility (VIX)

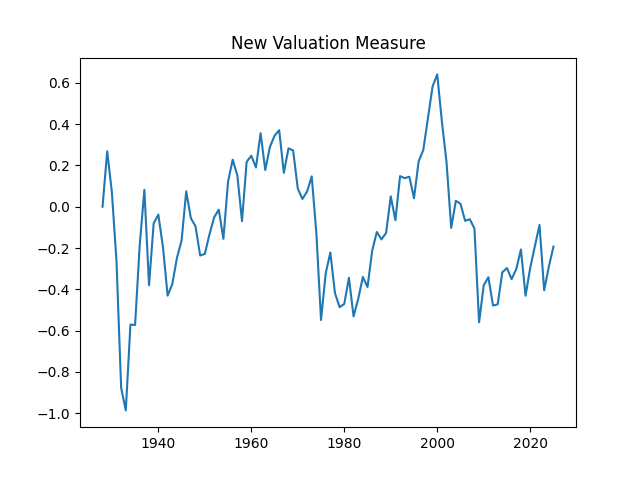

- S&P 500 Bubble Valuation Measure

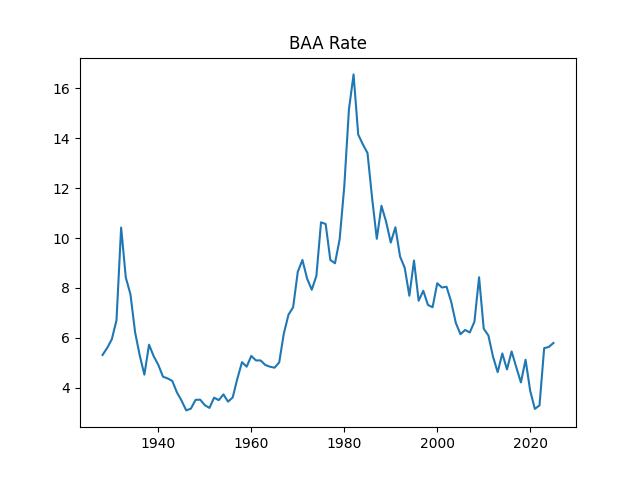

- Moody’s BAA Bond Rate

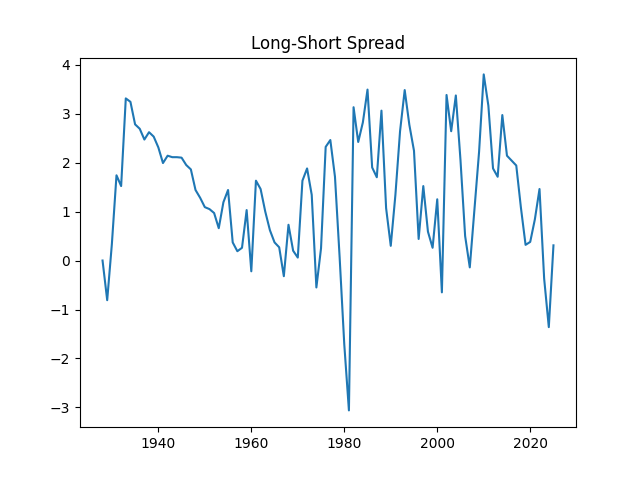

- Treasury 10Y – 3M Long-Short Bond Spread

We repainted the button Compute in orange. For the advanced option, we made the legend font and the web page font smaller. And we updated the default initial conditions for the main version of the simulator to make it for June 2025.

See the historical graphs of these four measures below. We can see their historical range. We included them in the HTML page for the advanced version of the simulator.

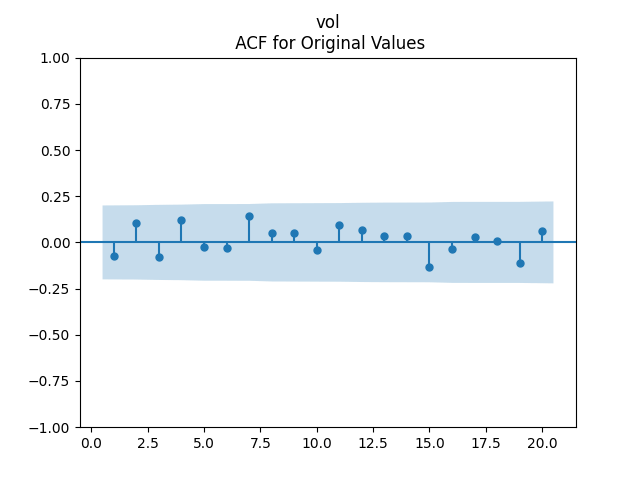

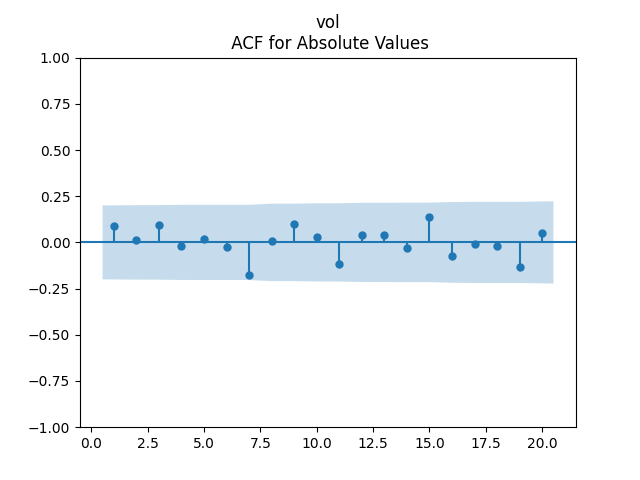

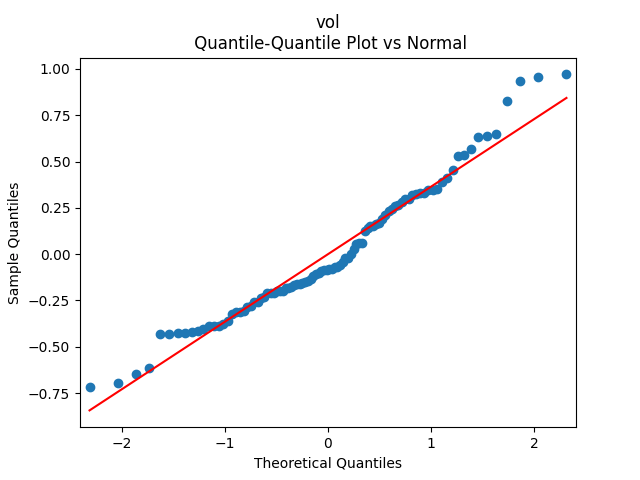

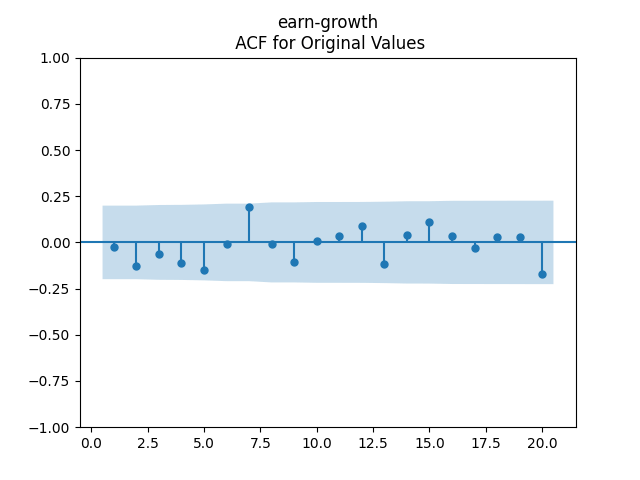

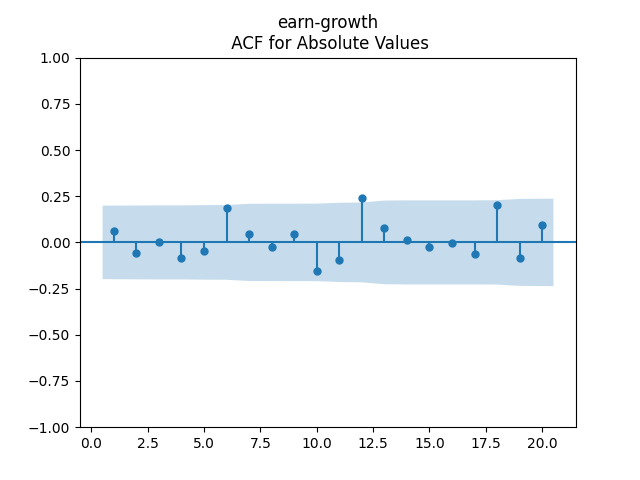

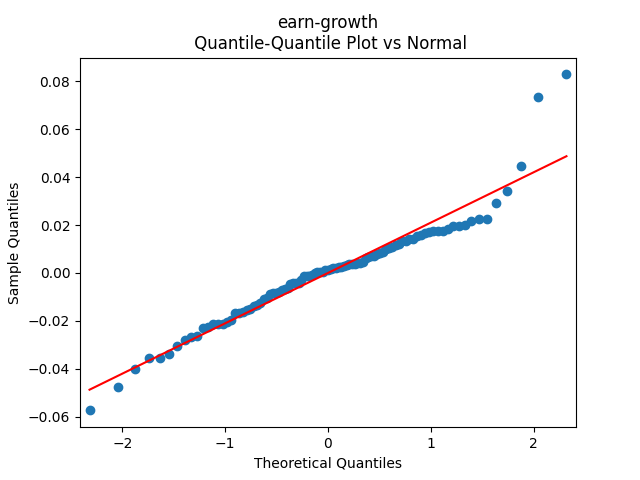

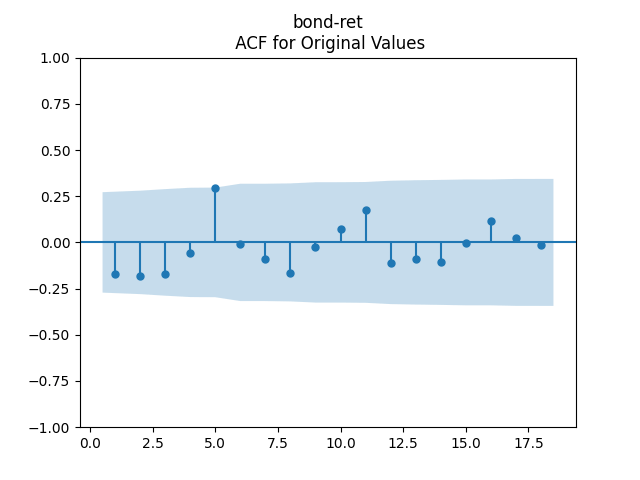

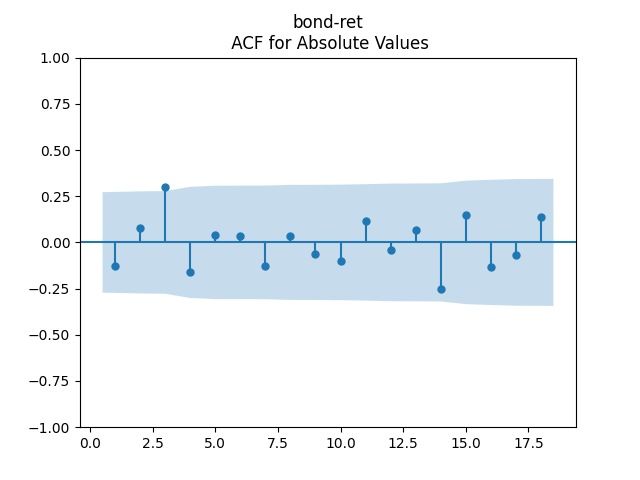

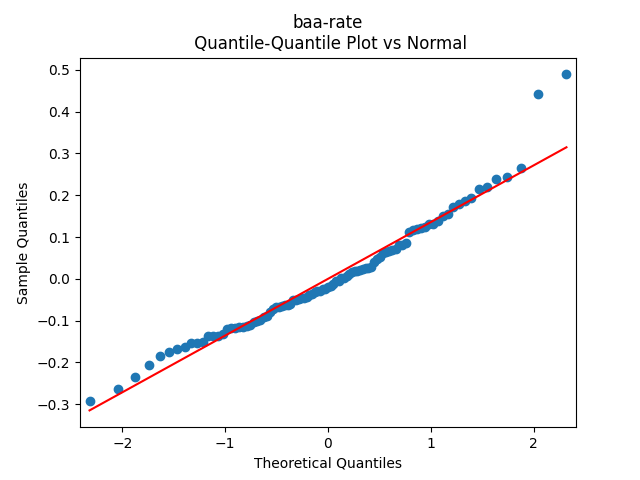

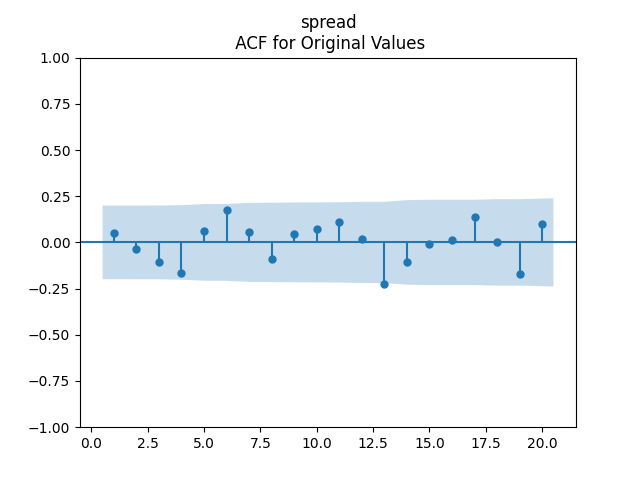

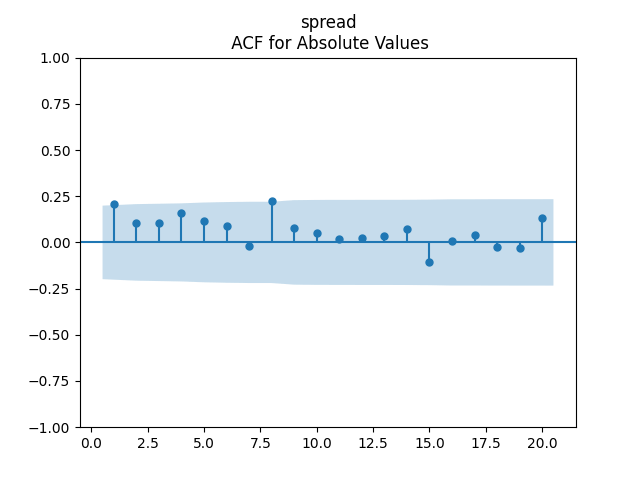

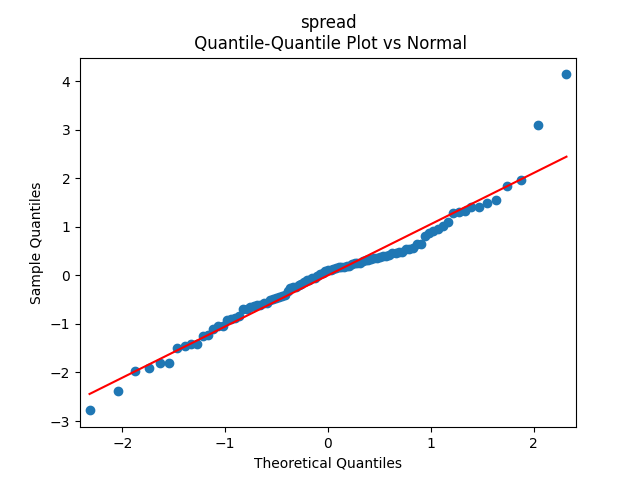

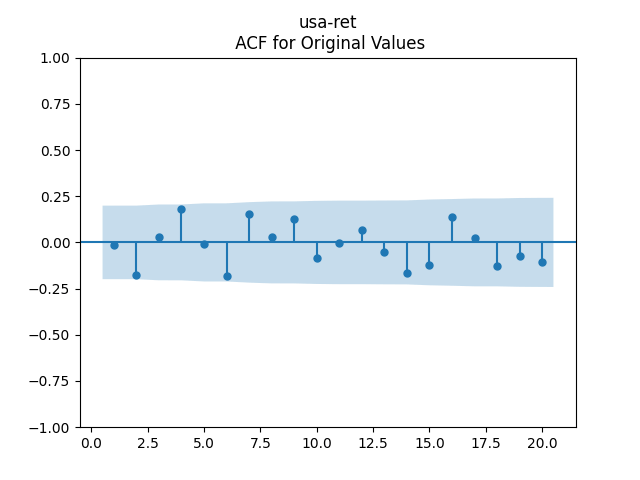

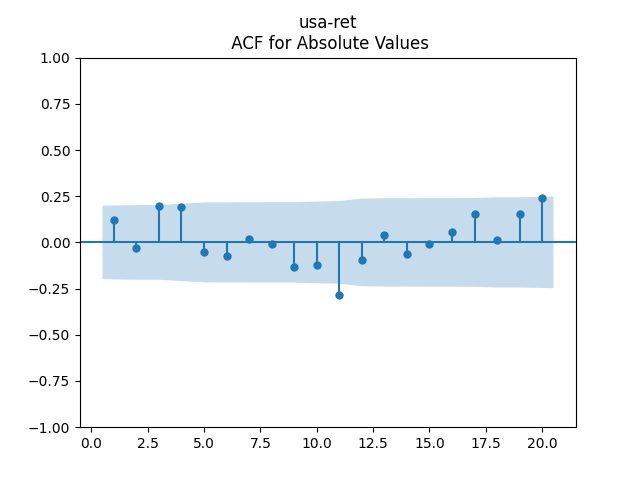

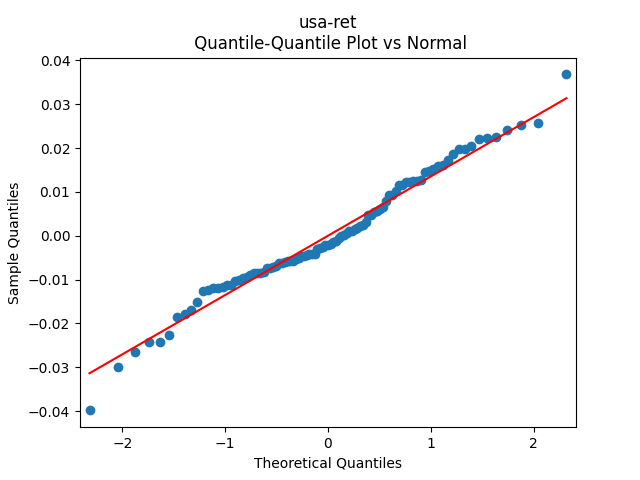

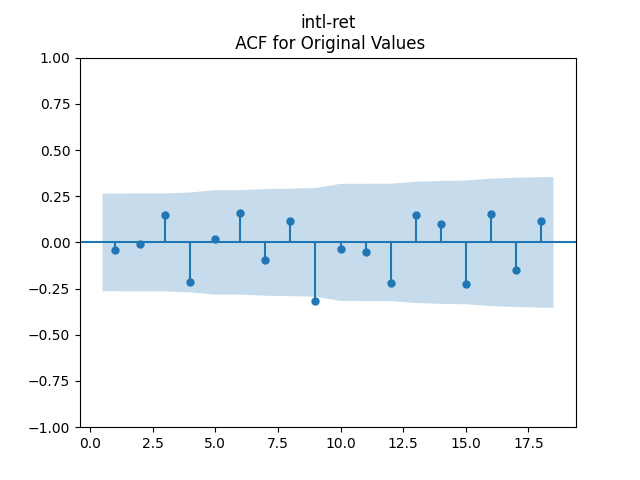

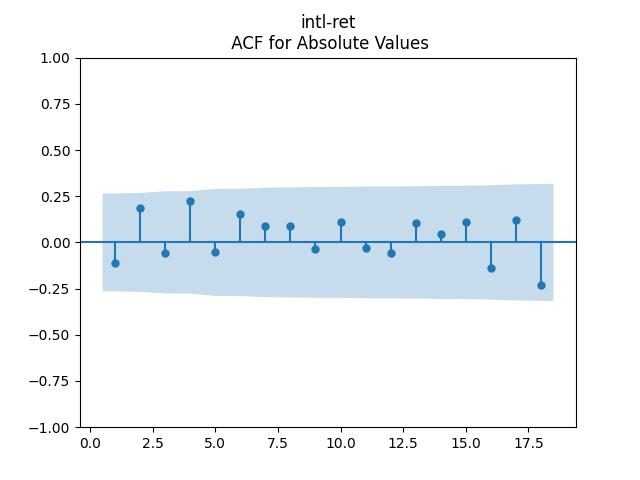

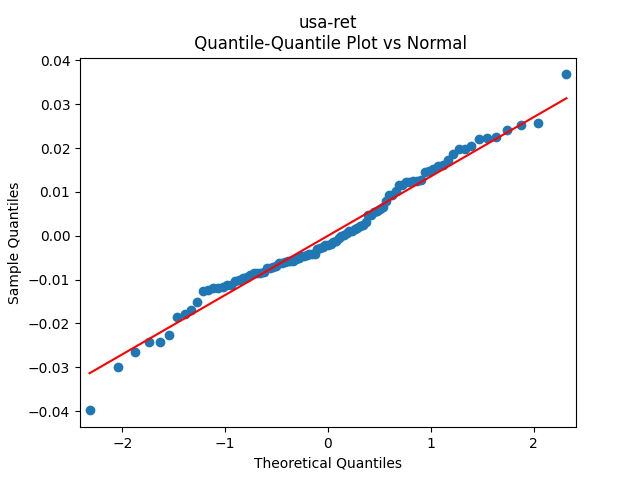

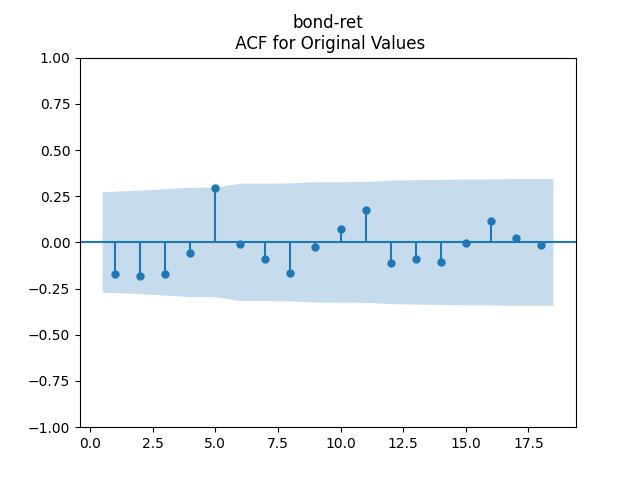

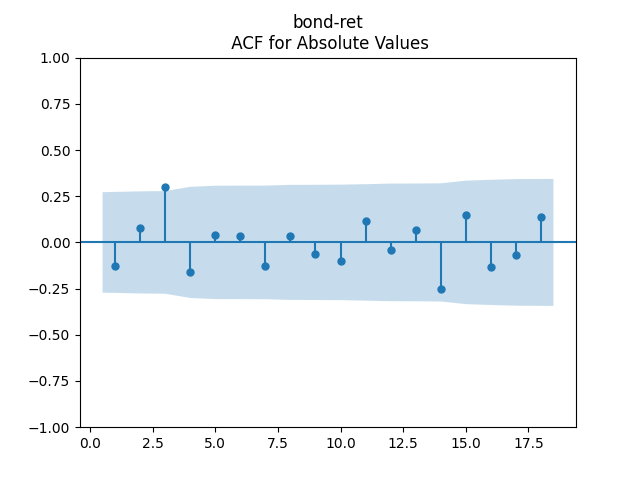

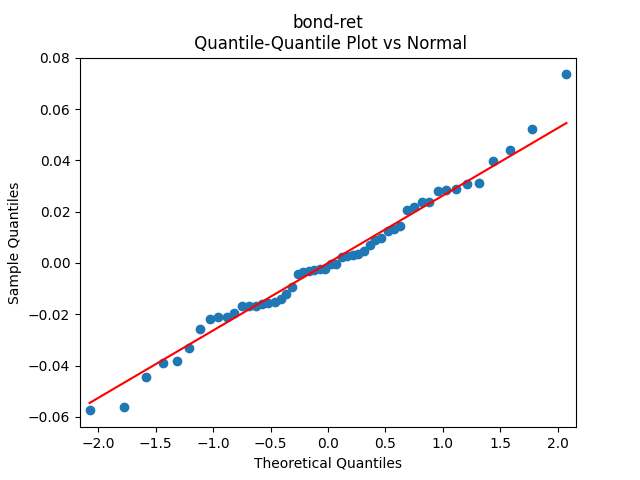

Below we see the autocorrelation function plots for original and absolute values, and the quantile-quantile plot versus the normal distribution, of residuals for each of the seven regressions. First, let us consider four factors: volatility, BAA rate, and spread (autoregressions for logarithms) and earnings growth divided by volatility (needed to compute the evolution of the bubble measure; here no regression).

Then consider regression residuals for total returns of three asset classes: S&P 500, International Stocks, USA Corporate Bonds.

Leave a comment