I am back! Now let me reduce the complexity of this model to model factors: log volatility, log BAA rate, and long-short Treasury spread, only using one-dimensional simple autoregressions, possibly with non-Gaussian independent identically distributed innovations. Different series of innovations might correlate.

We have the following differences from the previous setting:

logarithm of the BAA rate is modeled as

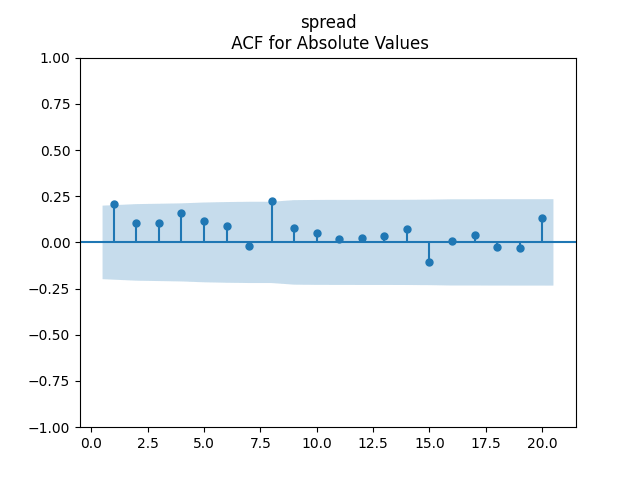

and the spread is modeled as

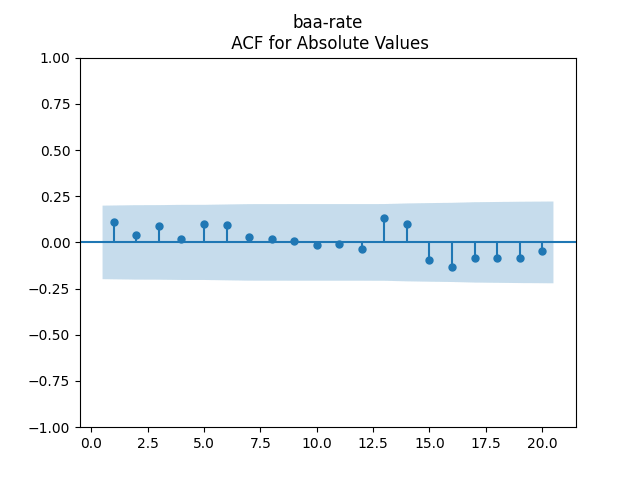

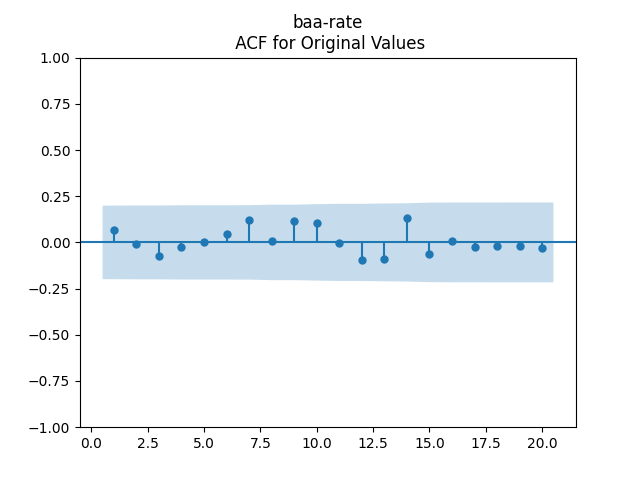

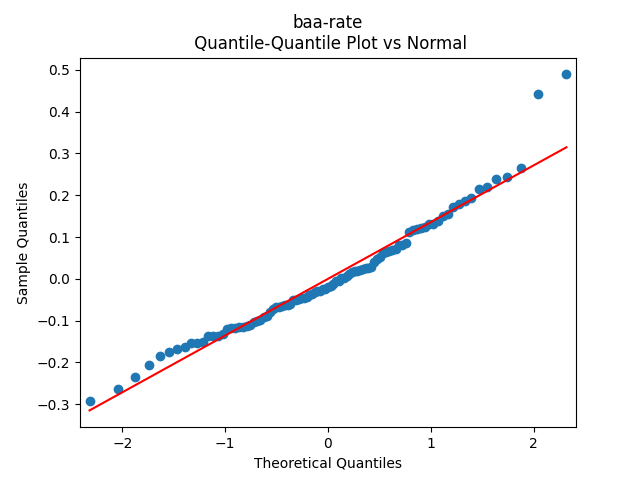

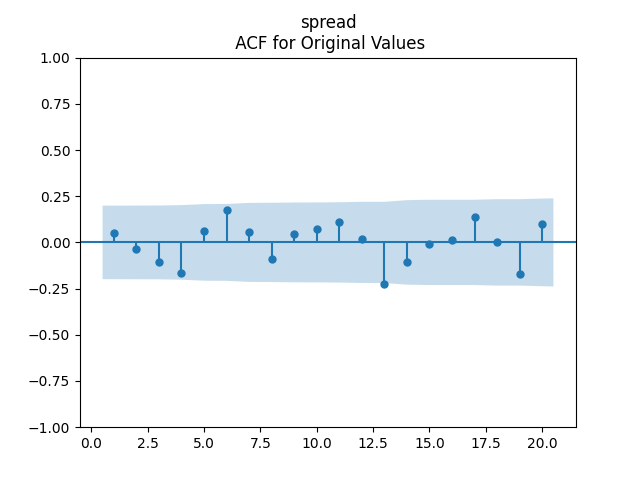

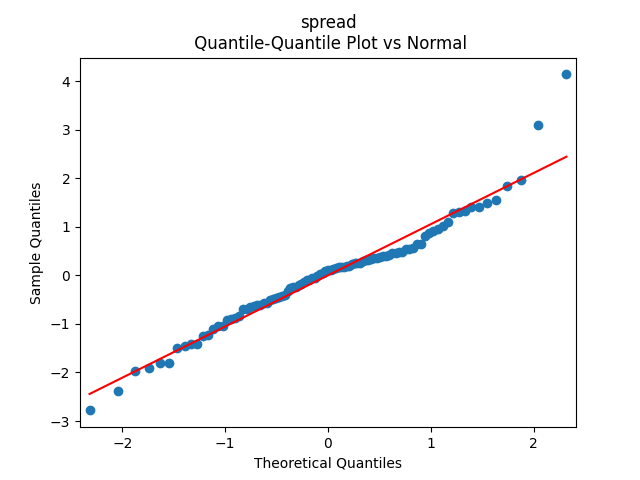

Analysis of residuals for these is given below. You can see that residuals (innovations) are IID and close to normal.

We shall not present here all residuals analysis, instead referring the reader to the new GitHub repository, but results are almost the same as before. If I have time, I will write a detailed description of analysis of residuals. Next, we need to move to an advanced version of the simulator, which allows you to choose factor values.

Leave a comment