Introduction. Here I talk about improvement of my financial simulator. So far, I have the following factors:

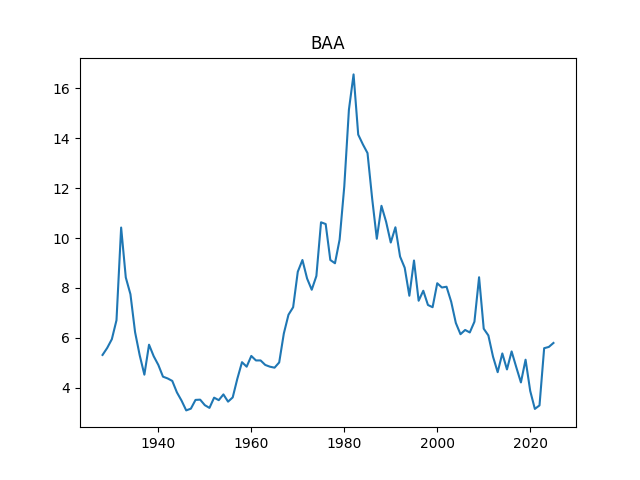

- BAA corporate bond rate, average December

- Annual volatility, S&P 500

I decided to include two more important factors:

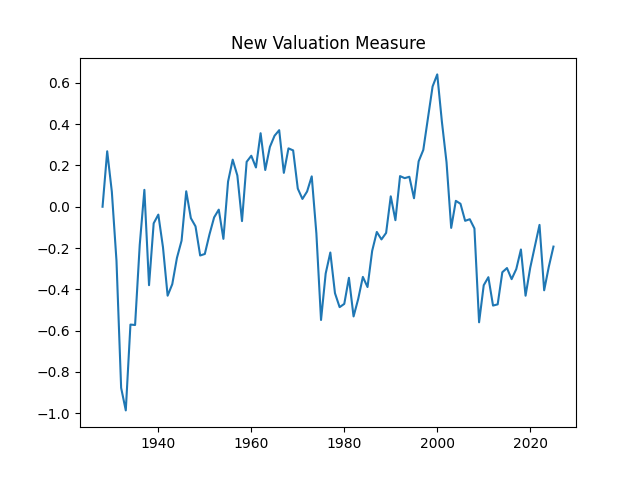

- A bubble measure, which is an improvement over Robert Shiller’s cyclically adjusted price-earnings ratio (CAPE), for which he got a Nobel Prize in Economics. We discussed it here and here and here.

- The long-short spread between 10-year and 3-month (average December) Treasury rates, which is often quoted as an important indicator. For example, if it is negative (inverted yield curve), then a recession is looming. We discussed it here and here and here.

We will now use annual earnings of S&P for our research. This is important, since it connects stock returns with fundamentals. This is similar to computing bond returns using bond rates. Robert Shiller used this comparison for his work. And we use this comparison to make our valuation measure. But, of course, stocks are much more volatile than bonds. So it’s harder to model.

Since we covered so much in previous posts, here we will be brief. For the person who wants to know details, we refer to GitHub repository.

Results. 1. First, recall the autoregression of order 1 for annual volatility:

Recall that

2-3. Then, modify the autoregression for log BAA rate to include spreads:

This is vector autoregression of order 1:

It does NOT include volatility. It has intercept and the slope matrix

4. Model annual earnings by considering its growth:

We model this as a regression

As usual, we fit it after dividing by volatility. We have

5. Next, we consider the bubble measure computed as in the above blog posts, with 10-year averaging window, and without using volatility. We get for

and

6. We fit the corporate bond returns (geometric) denoted by in the same way as above. Namely,

This makes sense in the context of bond markets, even though we use geometric instead of arithmetic returns here. Note that this does not use volatility. Similar to the above post, we see:

7. Next, we fit the geometric Standard & Poor 500 returns by dividing it by volatility

We also do regression versus

The quantity plays the role of the duration: Dependence upon the change in interest rates. This coefficient is negative because returns of stocks and bonds decrease when interest rates increase. Next,

is the coefficient for the bubble measure. Of course, this is also negative, since being in a bubble implies low future returns. Same is true for the long-short spread, as discussed at the top of this post. Numerical values of coefficients are:

8. Finally, for international stocks we do the same. Thus we write this regression as

Note that is still the duration. Although

is BAA rate, which is the USA, but it influences the international stocks as well. Same for the bubble measure. Numerical values of coefficients are:

Remark. In the regression for earnings growth, we tried instead of

, but the p-value for the Student test is too large. Also, we tried

instead of

, but the p-value for the Student test is too large. We used covariates in linear regressions if

Similarly, for the international stocks, we found that spread

is not statistically significant.

Innovations. Thus we have 8 (eight) innovation series. Only for

can be modeled as Gaussian. But all of them, judging by the autocorrelation function for

and for

and other tests, can be modeled as independent identically distributed random variables.

I do not have energy to present all these plots for each innovation series. But below is the table. Here, ACF is the L1 norm for the first 5 lags of the autocorrelation function values. Kurtosis is normalized so for normal distribution it is zero. Of course, the same is true for skewness.

| Series | Length | Skewness | Kurtosis | Shapiro-Wilk p | Jarque-Bera p | ACF original values | ACF absolute values |

| Volatility | 96 | 0.401 | 0.401 | 0.401 | 0.401 | 0.401 | 0.237 |

| BAA rate | 97 | 0.008 | 1.754 | 0.008 | 0.002 | 0.375 | 0.655 |

| Long-short spread | 97 | 1.058 | 3.382 | 0.000 | 0.000 | 0.455 | 0.468 |

| Earnings growth | 97 | 0.614 | 2.903 | 0.000 | 0.000 | 0.474 | 0.253 |

| Bubble measure | 97 | -0.816 | 1.102 | 0.003 | 0.000 | 0.291 | 0.608 |

| US corporate bond returns | 52 | 0.193 | 0.238 | 0.857 | 0.800 | 0.878 | 0.706 |

| US stock returns | 97 | 0.039 | 0.157 | 0.344 | 0.940 | 0.413 | 0.590 |

| International stock returns | 55 | -0.015 | -0.202 | 0.941 | 0.953 | 0.527 | 0.331 |

Covariance matrix

Correlation matrix

See below the p-values for the Student T-test for null hypothesis which is zero correlation between series of innovations.

Leave a comment