This is the work by my undergraduate student Ian Anderson, continued from the previous post. He showed that annual earnings growth (nominal or real) are not Gaussian white noise. But after dividing these growth terms by annual volatility (computed by my other undergraduate student Angel Piotrowski) they indeed become Gaussian white noise.

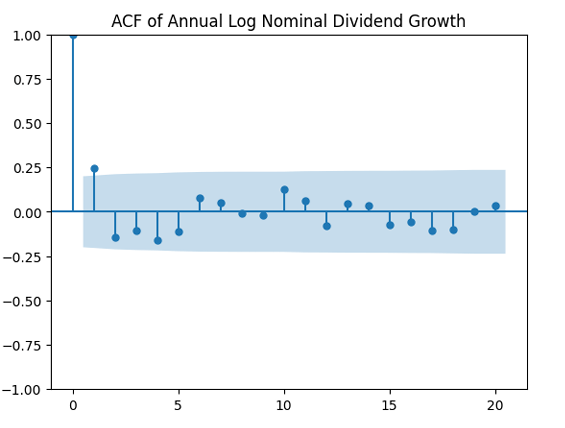

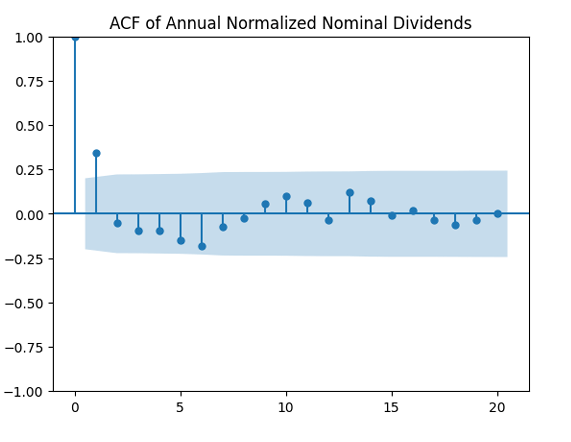

Ian continued his work for dividend growth instead of earnings growth. The data is taken from Robert Shiller’s data library, as for earnings. But the results are negative in this case. The autocorrelation function plots for nominal dividend growth is shown on the left. After dividing by annual volatility

the autocorrelation plot for

is shown on the right. It is clear there is significant autocorrelation with lag 1. Both plots seem to be for white noise, no autocorrelation.

I think that this is because dividends are persistent: Companies are reluctant to cut dividends even in poor times. This is why there are significant autocorrelations.

Leave a comment